Here's Why Shareholders May Consider Paying Goldmoney Inc.'s (TSE:XAU) CEO A Little More

The decent performance at Goldmoney Inc. (TSE:XAU) recently will please most shareholders as they go into the AGM coming up on 13 September 2021. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

See our latest analysis for Goldmoney

How Does Total Compensation For Roy Sebag Compare With Other Companies In The Industry?

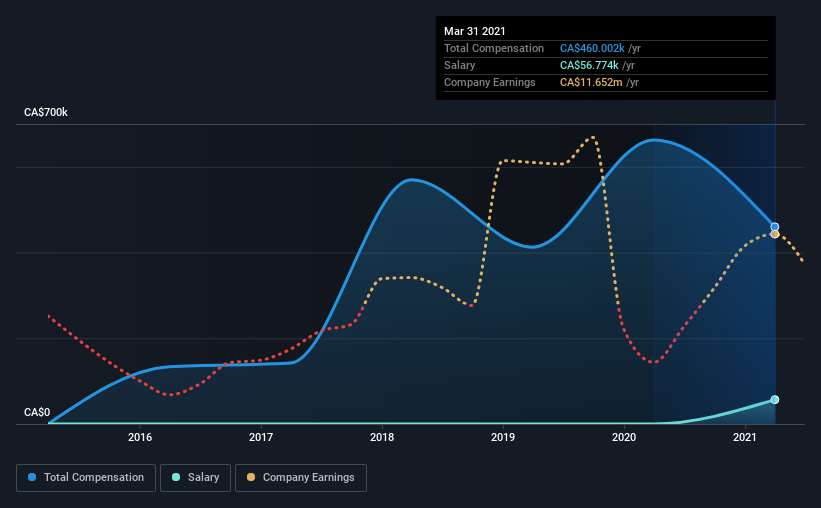

At the time of writing, our data shows that Goldmoney Inc. has a market capitalization of CA$209m, and reported total annual CEO compensation of CA$460k for the year to March 2021. That's a notable decrease of 31% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$57k.

On comparing similar companies from the same industry with market caps ranging from CA$125m to CA$502m, we found that the median CEO total compensation was CA$1.3m. Accordingly, Goldmoney pays its CEO under the industry median. What's more, Roy Sebag holds CA$45m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2021 | 2020 | Proportion (2021) |

Salary | CA$57k | CA$1.0 | 12% |

Other | CA$403k | CA$663k | 88% |

Total Compensation | CA$460k | CA$663k | 100% |

Speaking on an industry level, nearly 19% of total compensation represents salary, while the remainder of 81% is other remuneration. Goldmoney pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Goldmoney Inc.'s Growth Numbers

Over the past three years, Goldmoney Inc. has seen its earnings per share (EPS) grow by 32% per year. In the last year, its revenue changed by just 0.7%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Goldmoney Inc. Been A Good Investment?

Goldmoney Inc. has not done too badly by shareholders, with a total return of 9.9%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Goldmoney that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance