Here's Why You Should Retain Matador Resources (MTDR) Stock

Matador Resources Company MTDR is well poised to grow on the back of robust Permian performance and solid midstream business.

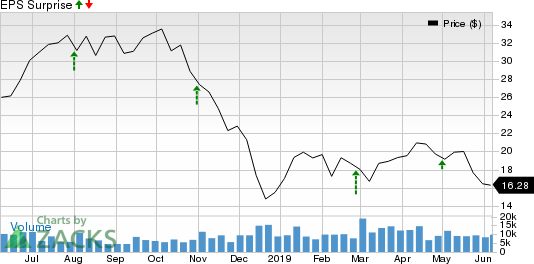

The company — with a market cap of $1.9 billion — has an expected earnings growth rate of 17.7% for the next five years. For second-quarter 2019, its earnings per share projection has increased from 26 cents to 30 cents in the past 30 days. The stock witnessed positive estimate revisions from three firms in the said period. The company beat estimates in each of the trailing four quarters, with the average being 26.2%.

Matador Resources Company Price and EPS Surprise

Matador Resources Company price-eps-surprise | Matador Resources Company Quote

Courtesy of solid prospects, this Zacks Rank #3 (Hold) stock is worth holding on to at the moment.

What’s Driving the Stock?

Matador Resources’ upstream operations are mainly concentrated in the Permian Basin, which is among the country’s most prolific oil and gas plays. The company has boosted its Permian Acreage drastically since 2011. Its operation now covers 115,000 net acres in the Permian Basin from 6,700 net acres in 2011. This enables the company to increase output.

Its plan to boost year-over-year production despite lower capital spending through 2019 reflects improving operational and capital efficiency. Notably, Matador Resources expects oil production through 2019 in the band of 12.9-13.3 million barrels, indicating 18% year-over-year increase at the midpoint.

There is a high demand for midstream infrastructures like oil and gas transportation, as well as gathering assets in the U.S. shale plays. The company is well equipped to reap profit from this situation. Notably, through the March quarter of 2019, it recorded more than $1 billion in value — which is significantly higher than both first-quarter 2018 and first-quarter 2017 — from Delaware midstream assets.

Downsides

However, there are a few factors that are impeding the growth of the stock lately.

Matador Resources’ free cash flows have been negative over the past few years. This increased the probability of more reliance on debt and equity capital for funding future growth projects. The company already has significant reliance on debt. Matador Resources’ balance sheet weakness is reflected by the fact that the cash balance declined more than 67% year over year, while long-term debt increased significantly through the March quarter of 2019. The decreasing liquidity would make it difficult for the company to finance growth projects.

Matador Resources’ rising expenses are concerning. Through 2018, production taxes, transportation and processing expenses rose 30% and lease operating expenses increased 38%. Moreover, through the first quarter of 2019, the company’s lease operating expenses rose 41%, hurting the profit levels. Its bottom line will be hurt if the situation persists.

To Sum Up

Despite riding on significant growth prospects as mentioned above, increasing costs and reliance on debt are concerns for the company. Nevertheless, we believe that systematic and strategic plan of action will drive its long-term growth.

Key Picks

Some better-ranked players in the energy space are Chevron Corporation CVX, Hess Corporation HES and Holly Energy Partners, L.P. HEP. All these companies carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chevron’s second-quarter 2019 earnings growth is projected at 14.6%.

Hess’ earnings are expected to soar more than 127% through 2019.

Holly Energy’s earnings growth is projected at 6.5% through 2019.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Holly Energy Partners, L.P. (HEP) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance