Here's Why You Should Retain AMN Healthcare (AMN) Stock for Now

AMN Healthcare Services, Inc. AMN is well-poised for growth in the coming quarters, courtesy of its broad array of services. The optimism led by a solid first-quarter 2023 performance and its healthcare Managed Services Program (“MSP”) are expected to contribute further. However, healthcare industry regulations and the consolidation of healthcare delivery units are major downsides.

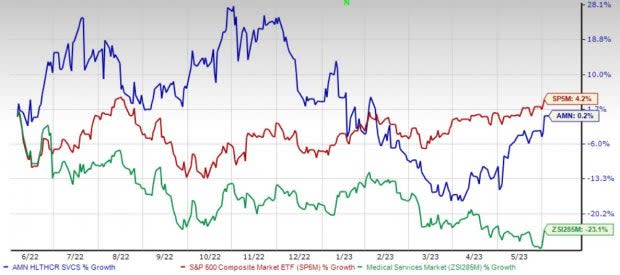

Over the past year, this Zacks Rank #3 (Hold) stock has gained 0.2% against a 23.1% decline of the industry and 4.2% rise of the S&P 500.

This renowned player in the healthcare total talent services space has a market capitalization of $3.95 billion. The company projects 3.3% growth for the next five years and expects to witness continued improvements in its business. AMN Healthcare surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 10.5%, on average.

Image Source: Zacks Investment Research

Let’s delve deeper.

Broad Array of Services: We are upbeat about AMN Healthcare’s business’ gradual evolution beyond traditional healthcare staffing. The company has become a strategic total talent solutions partner for its clients. The company’s suite of healthcare workforce solutions includes MSPs, vendor management systems and medical language interpretation services.

On the first-quarter 2023 earnings call in May, management confirmed that the company is continuing to elevate AMN Passport to be a digital staffing solution for all healthcare jobseekers at any stage of their careers across all businesses of AMN Healthcare.

Healthcare MSP: AMN Healthcare’s unique MSP is helping the company gain market traction. Notably, the program helps streamline the entire workforce planning process, which facilitates the delivery of improved patient care. This has resulted in a large network of improved patient care and efficiency.

In 2022, AMN Healthcare had approximately $5.3 billion in spend under management through its MSPs, and approximately 64% of its consolidated revenues flowed through MSP relationships.

Strong Q1 Results: Per management, the Technology and Workforce Solutions and Physician and Leadership Solutions segments exceeded expectations in the first quarter of 2023. The continued strength in AMN Healthcare’s Language Services also looks promising. The expansion of the gross margin bodes well. AMN Healthcare’s management confirmed that the company will be rolling out major enhancements to key parts of its technology. This looks promising for the stock.

Downsides

Healthcare Industry Regulations: The healthcare industry is subject to extensive and complex federal and state laws and regulations. AMN Healthcare provides talent solutions and technologies on a contractual basis to its clients who pay the company directly. Accordingly, Medicare, Medicaid and insurance reimbursement policy changes generally do not directly impact the company. Nevertheless, reimbursement changes in government programs, particularly Medicare and Medicaid, can and do indirectly affect the demand and the prices paid for the company’s services.

Consolidation of Healthcare Delivery Units: Healthcare delivery organizations are consolidating, giving them greater leverage in negotiating service pricing. Consolidations may also result in AMN Healthcare losing its ability to work with certain clients because the party acquiring or consolidating with its client may have a previously established service provider they opt to maintain.

Estimate Trend

AMN Healthcare has been witnessing a negative estimate revision trend for 2023. Over the past 90 days, the Zacks Consensus Estimate for its earnings per share has moved 0.6% south to $8.26.

The Zacks Consensus Estimate for second-quarter 2023 revenues is pegged at $987.9 million, suggesting a 30.8% decline from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Merit Medical Systems, Inc. MMSI and Boston Scientific Corporation BSX.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 5.1% for fiscal 2024. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average being 27.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 5.2% compared with the industry’s 2.6% growth in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 37.2% compared with the industry’s 7.7% rise over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 31.6% against the industry’s 31.1% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance