Here's Why Investors Should Hold lululemon (LULU) Stock for Now

lululemon athletica LULU looks well-poised on the back of its continued business momentum and robust traffic trends in stores and e-commerce. The company’s Power of Three ×2 growth strategy bodes well. The company has been capitalizing on the importance of physical retail and the convenience of online engagement, which is expected to boost its performance.

Driven by these factors, lululemon reported the 11th straight quarter of an earnings surprise in fourth-quarter fiscal 2022, while sales beat estimates for the fourth straight quarter. The top and bottom lines also grew year over year on the back of continued business momentum. Results outpaced our estimate in the quarter. Comps growth was aided by robust traffic trends in stores and e-commerce. On a three-year CAGR basis, traffic was up 7% in stores and more than 45% in e-commerce.

An uptrend in the Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company echoes a positive sentiment. The Zacks Consensus Estimate for lululemon’s fiscal 2023 sales and earnings per share (EPS) suggests growth of 15.7% and 14%, respectively, from the year-ago period’s reported numbers.

However, management’s commentary on elevated inventory levels at the end of the fiscal fourth quarter has hurt sentiment. lululemon has been grappling with soft margins due to elevated costs and higher SG&A expenses.

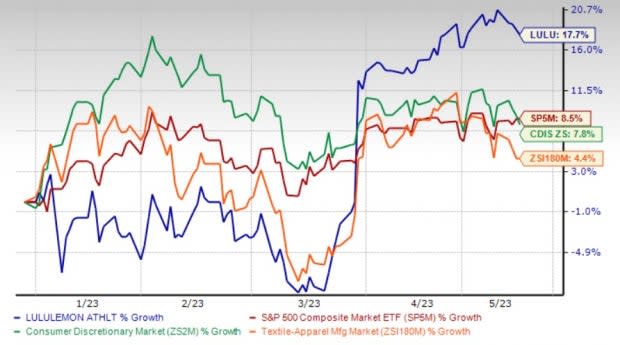

The stock has gained 17.7% in the year-to-date period compared with the industry’s growth of 4.4%. The stock also compared favorably with the Consumer Discretionary sector’s growth of 7.8% and the S&P 500’s rally of 8.5%.

Image Source: Zacks Investment Research

Factors Driving Growth

lululemon is poised to benefit from a rebound in brick-and-mortar sales, driven by an increase in store traffic, as consumers returned to stores for shopping. Management highlighted that store productivity in the fourth quarter of fiscal 2022 continued to trend above the 2019 level. The company has been focused on investments to enhance its in-store experience. It is leveraging its stores to facilitate omni-channel capabilities, including the buy online pickup in store and ship from store.

lululemon has implemented several strategies to improve its guest experience and reduce wait time. These include virtual waitlist, mobile point of sale and appointment shopping. These functionalities enable reducing the time of waiting in line to enter the store and allow customers to complete transactions like returns, exchanges and purchase of gift cards without entering the store. It continues to expand its store base.

In first-quarter fiscal 2023, the company expects to open five to 10 net new company-operated stores. Management expects to open 45-50 net new company-operated stores in fiscal 2023, along with the completion of 25 co-located remodels. The total store openings in fiscal 2023 will imply a square footage increase in the low-double digits. Store openings in fiscal 2023 are likely to include 30-35 in the international markets, with the majority of these planned to be opened in China.

lululemon expects to capture the growing online demand and ensure a robust shopping experience through accelerated e-commerce investments. It has been investing in developing sites, building transactional omni functionality and increasing fulfillment capabilities.

Encouraged by robust gains from the pandemic-led athleisure boom, lululemon announced its Power of Three ×2 growth strategy. The move is likely to double its revenues from $6.25 billion in 2021 to $12.5 billion by 2026. The plan focuses on three key growth drivers, including product innovation, guest experience and market expansion.

The five-year plan is likely to quadruple international sales, along with doubling digital and menswear sales. Also, the women’s business and North America operations are anticipated to witness a low-double-digit CAGR in revenues, with store channel growth in mid-teens in the next five years. As part of its strategy, the company intends to expand in China and Europe markets, with plans to open stores in Spain and Italy.

For 2021-2026, the total net revenue CAGR is expected to be 15%, with a slight expansion in the operating margin on an annual basis. lululemon anticipates bottom-line growth to outpace revenue growth. Although the 2026 targets seem too bold, the company believes that these are achievable due to its strong financial position.

Headwinds to Overcome

Although lululemon reported strong fiscal fourth-quarter results, management’s commentary on elevated inventory levels at the end of the quarter hurt investors’ sentiment. lululemon’s inventory grew 49.8% to $1,447.4 million at the end of fiscal 2022. This included a $62.9-million provision against the inventory related to lululemon Studio, which reduced the inventory growth rate by seven percentage points.

The company noted that the off-season made up for about 45% of its inventory. In fiscal 2023, management expects inventory growth to moderate, while maintaining its full-price selling model and remaining well-positioned to fulfill guest demand. lululemon expects the inventory growth rate at the end of the fiscal first quarter to increase 30-35% from the last year. It also expects inventory growth to be in line with sales growth in the second quarter of fiscal 2023.

Stocks to Consider

Some better-ranked stocks to consider are Crocs Inc. CROX, PVH Corporation PVH and NIKE Inc. NKE.

Crocs carries a Zacks Rank #2 (Buy) at present. Shares of CROX have rallied 7.7% year to date. The company has a trailing four-quarter earnings surprise of 19.6%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Crocs’ current-year sales and EPS suggests growth of 13% and 5.6%, respectively, from the year-ago reported figures. It has a long-term earnings growth rate of 15%.

PVH Corp currently carries a Zacks Rank #2. PVH has a trailing four-quarter earnings surprise of 23.4%, on average. Shares of PVH Corp have rallied 17.4% year to date.

The Zacks Consensus Estimate for PVH Corp’s current financial-year sales and earnings suggests growth of 3.7% and 11.8%, respectively, from the year-ago period's reported figure. The company has a long-term earnings growth rate of 16.1%.

NIKE currently has a Zacks Rank of 2. NKE has a trailing four-quarter earnings surprise of 24%, on average. Shares of NIKE have gained 4.5% year to date.

The Zacks Consensus Estimate for NIKE’s current financial-year sales suggests growth of 9.1% from the year-ago period's reported numbers, whereas the same for earnings suggests a decline of 13.6%. The company has a long-term earnings growth rate of 10.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance