Here's Why You Should Hold Equity Residential (EQR) Stock Now

Equity Residential EQR is well-positioned to grow on portfolio rebalancing in the urban and suburban markets, improving demand for apartment living and a healthy balance sheet. The company is one of the leading, fully integrated, publicly-traded multi-family real estate investment trusts (REITs) in the United States.

Equity Residential’s diversified presence in the urban and suburban markets of Boston, New York, Washington, DC, Seattle, San Francisco and Southern California helped it survive the pandemic. While demand was lower in the urban markets, the suburban markets remained comparatively stable.

EQR focuses on adding affluent renters to its roster, thereby successfully tapping the recent migration trends. It also engages in acquiring and developing properties in suburban locations of its established markets and has been adding select new markets like Atlanta, GA and Austin, TX, to its portfolio. Therefore, efforts to diversify its portfolio continued to support financials amid the pandemic.

The company is also concentrating on optimizing its technology and organizational capabilities to achieve innovation, rent growth and improve the efficiency of its operating platform. It finished deploying the centralized renewal process in the first quarter of 2022 and is now focused on centralizing the application process. These efforts are likely to provide EQR with a competitive edge over its peers.

Moreover, it has taken steps toward repositioning its portfolio. It is getting rid of properties that are either old or are in jurisdictions with challenging regulatory environments or are over-concentrated in the submarkets. Equity Residential is replacing those properties by acquiring newer properties in the submarkets with higher affluent renters, favorable long-term demand drivers and manageable forward supply. These initiatives reflect strategic diversification and incremental development activities to make the most of the rising demand for rental apartment units.

EQR has been consistent in paying dividends to its shareholders, which remains a huge attraction for REIT investors. In March 2022, the residential REIT announced increasing its annualized dividend by 3.7% to $2.50 per share. Considering its robust balance sheet position and a recovery in business, the company is likely to maintain its dividend payout in the forthcoming quarters.

Analysts seem to be bullish on this Zacks Rank #3 (Hold) stock. The estimate revisions trend for 2022 funds from operations (FFO) per share indicates a favorable outlook for the company as it has been increased marginally over the past month. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

However, the continuation of the flexible working environment has resulted in lower renter demand for costlier and urban/infill markets, which is a pressing concern for EQR now. Several temporary regulatory laws imposed during the pandemic have curbed the company’s ability to evict tenants or charge late fees to those who have defaulted on rent payments.

Also, stiff competition from other housing alternatives like rental apartments, condominiums and single-family homes restricts Equity Residential from raising rents, thereby stalling its growth pace to a certain extent.

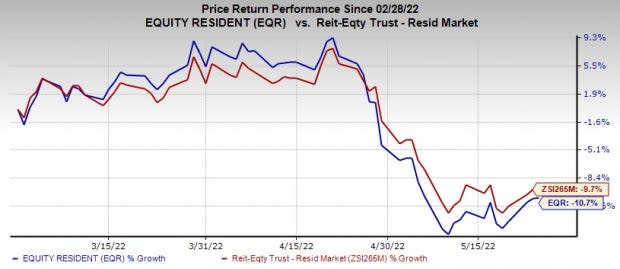

Shares of Equity Residential have declined 10.7% in the past three months compared with the industry’s fall of 9.7%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the REIT sector are American Campus Communities ACC, Independence Realty Trust IRT and BRT Apartments BRT.

The Zacks Consensus Estimate for American Campus Communities’ 2022 FFO per share has moved 0.8% upward in the past two months to $2.47. ACC presently carries a Zacks Rank of 2.

The Zacks Consensus Estimate for Independence Realty Trust’s current-year FFO per share has moved roughly 1% northward in the past month to $1.05. IRT also carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for BRT Apartments’ ongoing year’s FFO per share has been raised 18.5% over the past month to $1.54. BRT carries a Zacks Rank #1 (Strong Buy), currently.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equity Residential (EQR) : Free Stock Analysis Report

American Campus Communities Inc (ACC) : Free Stock Analysis Report

BRT Apartments Corp. (BRT) : Free Stock Analysis Report

Independence Realty Trust, Inc. (IRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance