Here's Why You Should Hold on to Cenovus (CVE) Stock Now

Cenovus Energy Inc. CVE is well poised to grow on the back of strong presence in Alberta and British Columbia of Canada. However, rising fuel costs and a volatile commodity price environment are persistent concerns.

Calgary, Canada-based Cenovus is a leading integrated energy firm. Starting from pumping out oil from its oil sands projects in Canada, the company’s operations comprise marketing of the produced oil, natural gas and natural gas liquids (NGLs). Cenovus, with a market cap of $3.4 billion, has an expected earnings growth rate of 15.4% for the next five years.

Let’s delve deeper to find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Favoring the Stock?

From 2020 to 2024, Cenovus expects to see compound annual production growth of 2-3%. With disciplined capital investment and production growth, the integrated energy player projects consistent growth in earnings and fund flows during the period. To navigate through the current market uncertainty, the company has slashed 2020 capital spending twice by around $600 million from its original guidance of C$1.3-C$1.5 billion provided last December. Production is now expected within 432-486 thousand barrels of oil equivalent per day (MBoe/d), the upper limit of which is higher than the 2019 level of 451.7 MBoe/d.

Over the past few years, the company has managed to significantly lower debt burden, reflecting balance sheet strength. As of Dec 31, 2019, the Canadian energy player had total long-term debt of C$6,699 million, lower than the 2018 level of C$8,482 million. Importantly, the company’s debt-to-capitalization ratio stands at 25.9%, considerably lower than the energy sector’s more than 31%.

Cenovus has operations in the prospective oil sands development in Alberta, where it has been employing a specialized technique for drilling and pumping crude out of the surface. Moreover, the company intends to reduce costs from operations by C$100 million, and general and administrative expenses by C$50 million from its initial budget. It now expects general and administrative costs in the band of C$230-C$250 million. Notably, its board members will receive 25% reduced compensations. The company expects to reduce its oil sands operations’ sustaining costs to C$2.60 per barrel in 2020. This will boost the company’s profit levels.

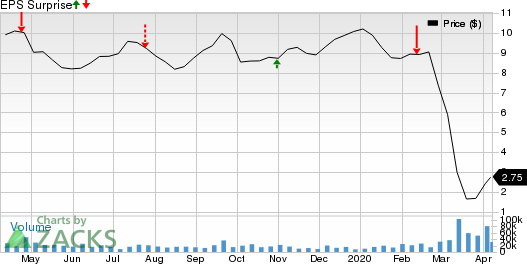

Cenovus Energy Inc Price and EPS Surprise

Cenovus Energy Inc price-eps-surprise | Cenovus Energy Inc Quote

Downsides

However, there are a few factors that are impeding the growth of the stock lately.

Through 2019, operating margin at the company’s refining and marketing business dropped significantly from the year-ago period. Turnaround activities are likely to continue hurting refining margin. Moreover, the company’s Christina Lake and Foster Creek projects, which were earlier expected to reach sanction-ready status in 2020, are kept on hold. Capital spending in its Deep Basin and Marten Hills operations is also likely to be suspended. It will now avoid making new projects sanctions owing to a low oil price environment.

Higher fuel costs for Cenovus’ steam injection operations might affect its profit levels from oil sands activities. Moreover, in 2020, Deep Basin output is expected to decline 15% from 2019 levels. Due to the current market uncertainty, the company temporarily suspended the crude-by-rail program, which is expected to halt the usage of credits under Alberta’s Special Production Allowance program. This will likely take a toll on its total production by 5%.

As commodity prices are now in the bearish territory since the coronavirus pandemic is hurting global energy demand, the outlook for exploration and production business seems gloomy. With no improvement at sight, the company’s profit levels will be further hurt in the coming quarters.

To Sum Up

Despite significant growth opportunities, increasing fuel costs and volatile commodity prices are concerns. Nevertheless, we believe that systematic and strategic plan of action will drive its long-term growth.

Stocks to Consider

Some better-ranked stocks in the energy sector are Murphy USA Inc. MUSA, FuelCell Energy, Inc. FCEL and Covanta Holding Corporation CVA, each holding a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Murphy USA’s bottom line for 2020 is expected to rise 7.7% year over year.

FuelCell’s bottom line for 2020 is expected to rise 70.8% year over year.

Covanta Holding beat earnings estimates thrice in the last four quarters, with the average positive surprise being 55%.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, SherazMian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FuelCell Energy, Inc. (FCEL) : Free Stock Analysis Report

Covanta Holding Corporation (CVA) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance