Here's Why Continental (CLR) is a Hot Investment Pick Now

Continental Resources, Inc. CLR looks compelling at the moment. Given the company’s strong fundamentals, it seems like this is the right time to add the stock to your portfolio.

Oklahoma City, OK-based Continental is an independent oil and natural gas exploration, and production company. Notably, the company currently has a Zacks Rank #2 (Buy), which means that it is poised to outperform the market. Let’s delve deeper to analyze the factors that make this upstream energy player an attractive investment option at the moment.

Premier Position

Continental holds a premier position in the Bakken area. The shale play, which is ranked among the country’s largest onshore oilfields, produces premium quality of crude. Bakken comprises almost 52% of the upstream energy player’s proved reserves. Notably, in this shale play, the company is planning to allocate roughly 50% of its capital budget for drilling and completion activities in 2019. This will lead to higher output and cash flow.

Production to Surge

Markedly, the company plans to operate 166 gross wells in Bakken through 2019, higher than 159 in 2018, indicating production growth potential. For 2019, oil production is expected in the range of 190,000-200,000 barrels per day (BPD), much higher than the 2018 level of 168,177 BPD. Moreover, natural gas is expected in the band of 790,000-810,000 thousand cubic feet per day (Mcf/d), above the 2018 level of 780,083 Mcf/d.

The company’s high-quality Bakken and Oklahoma assets, coupled with low-cost operations lead to sustainable free cash flow generation.

Free Cash Flow

In the trailing four quarters, it generated total free cash flow of $3,262 million. On an average, Continental’s free cash flow is expected to surge $700-$800 million per annum over the next five years, suggesting tremendous strength in operations. This will enable the company to stay on its track of debt reduction.

All the factors stated above make the stock a rewarding one. But one should consider estimate revisions and earnings history, along with strength in operations to understand its true potential.

Earnings History & Future Prospects

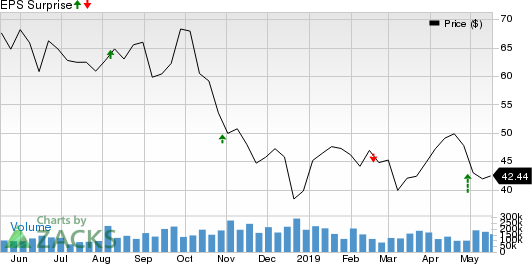

In the last reported quarter, the company’s earnings of 58 cents per share beat the Zacks Consensus Estimate of 47 cents, aided by higher production from the North Dakota Bakken, as well as SCOOP and STACK regions. Continental beat estimates thrice in the trailing four quarters, delivering average positive earnings surprise of 7.6%.

Continental Resources, Inc. Price and EPS Surprise

Continental Resources, Inc. price-eps-surprise | Continental Resources, Inc. Quote

The Zacks Consensus Estimate for second-quarter earnings of 65 cents has witnessed 12 upward revisions by firms in the past 30 days. Clearly, this energy stock has substantial upside potential.

Other Stocks to Consider

Other top-ranked players in the energy space include Hess Corp. HES, Cactus, Inc. WHD and USA Compression Partners, LP USAC. While Hess sports a Zacks Rank #1 (Strong Buy), Cactus and USA Compression hold a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hess’ earnings are expected to grow more than 115% through 2019.

Cactus’ earnings growth is projected at 11.8% through 2019.

USA Compression’s earnings growth is projected at 97.7% through 2019.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

USA Compression Partners, LP (USAC) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance