Here's Why You Should Buy Titan International (TWI) Stock Now

Titan International, Inc. TWI is benefiting from the solid demand and robust performance across all segments. Rising agricultural commodity prices and the consequent improvement in farmer income, and the need to replace old equipment are expected to support the Agricultural segment’s performance. The company will gain from the ramp-up in infrastructure spending in the United States.

Titan International currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Upbeat Outlook: Titan International expects 2022 sales to be around $2.2 billion and adjusted EBITDA between $225 million and $240 million. The company recently revised its prior guidance of sales expectation of $2 billion and adjusted EBITDA of $200 million. Solid momentum in its business, better-than-expected financial performance in the second quarter and a positive outlook for the remainder of the year contributed to this upbeat view. The company stated that this would be the strongest performance in its history. In 2021, TWI had reported sales of $1.78 billion and an adjusted EBITDA of $135 million.

Positive Growth Expectations: The Zacks Consensus Estimate for 2022 earnings stands at $2.25, which suggests a whopping surge of 165% from 2021. The consensus mark for revenues stands at $2.22 billion, indicating year-on-year growth of 24%.

Positive Earnings Surprise History: TWI has a trailing four-quarter earnings surprise of 56.4%, on average.

Solid ROE: TWI’s superior return on equity (ROE) is indicative of its growth potential. The company’s ROE currently stands at 37.6%, which is higher than the industry’s 33.2%. This indicates efficiency in using shareholders’ funds and the ability to generate profit with minimum capital usage.

Solid Demand in Markets

The company’s Agricultural segment has been benefiting from increased commodity prices, improved farmer income, replacement demand of an aging large equipment fleet, and lower equipment inventory levels. The Consumer segment has been witnessing higher volumes related to general market improvements. Recovery in construction markets has been driving the Earthmoving/Construction segment’s performance. The ramp-up in infrastructure spending in the United States is expected to act as a significant growth catalyst in the days ahead.

Pricing actions undertaken to offset rising raw material costs and other inflationary impacts in the markets, including freight, and savings from productivity improvements across all production facilities, are expected to contribute to earnings growth.

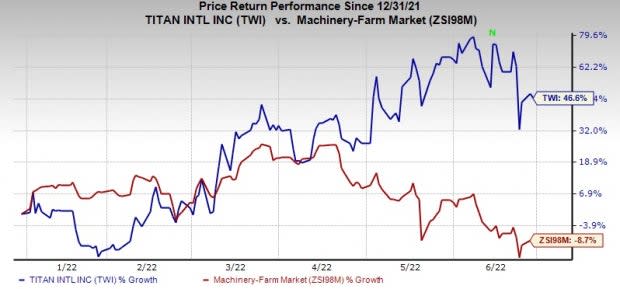

Price Performance

Image Source: Zacks Investment Research

Titan International’s stock has surged 46.6% so far this year against the industry’s decline of 8.7%.

Other Stocks to Consider

Some other top-ranked stocks in the Industrial Products sector are Greif Inc. GEF, Myers Industries MYE and Amcor plc AMCR. Greif and Myers Industries sport a Zacks Rank #1 at present, while Amcor carries a Zacks Rank #2 (Buy).

Greif has an estimated earnings growth rate of 36% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 17%.

Greif pulled off a trailing four-quarter earnings surprise of 22.9%, on average. The company’s shares have gained 4% year to date.

Myers Industries has an expected earnings growth rate of 67% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 27% in the past 60 days.

MYE has a trailing four-quarter earnings surprise of 20.1%, on average. Year to date, Myers Industries’ shares have risen 6%.

Amcor has an estimated earnings growth rate of 9.5% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 3%.

Amcor pulled off a trailing four-quarter earnings surprise of 2.4%, on average. The company’s shares have appreciated 3% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Myers Industries, Inc. (MYE) : Free Stock Analysis Report

Amcor PLC (AMCR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance