Here's Why You Should Buy FleetCor Technologies (FLT) Stock

A prudent investment decision involves buying well-performing stocks at the right time, while selling those that are at risk. A rise in share price and strong fundamentals signal a stock’s bull run.

FleetCor Technologies, Inc. FLT is a Financial Transaction Services stock that has performed well so far this year and has the potential to sustain the momentum in the near term. So, if you haven’t taken advantage of its share price appreciation yet, it’s time you add the stock to your portfolio.

What Makes it an Attractive Pick?

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run on the bourse so far this year. Shares of FleetCor have returned 62.1%, outperforming the 42.7% growth of the industry it belongs to.

Solid Rank: FleetCor currently carries a Zacks Rank #2 (Buy). Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or 2 offer attractive investment opportunities for investors. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: Seven estimates for 2019 moved north in the past 30 days versus three downward revisions, reflecting analysts’ confidence in the company. Over the same period, the Zacks Consensus Estimate for 2019 inched up to $11.74 from $11.73.

Positive Earnings Surprise History: FleetCor has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in the trailing four quarters, delivering a positive average earnings surprise of 2.1%.

Strong Growth Prospects: The Zacks Consensus Estimate for 2019 earnings is currently pegged at $11.74, indicating year-over-year growth of 11.5%. Moreover, earnings are expected to register 15.1% growth in 2020. The stock has long-term expected earnings per share growth rate of 15.6%.

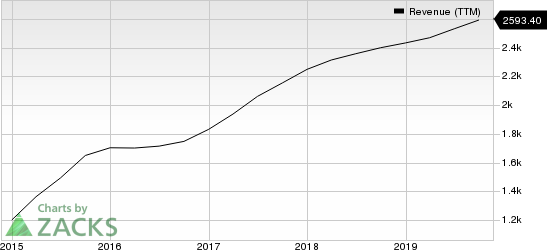

Growth Drivers: FleetCor’s top line continues to grow organically driven by increase in both volume and revenue per transaction in certain of its payment programs. In third-quarter 2019, organic revenue growth was 11%.

FleetCor Technologies, Inc. Revenue (TTM)

FleetCor Technologies, Inc. revenue-ttm | FleetCor Technologies, Inc. Quote

Acquisitions are contributing significantly to FleetCor’s top line. During the third quarter, the company witnessed $9 million of additional revenues from the acquisitions completed in 2019. The recent acquisition of Nvoicepay is expected to expand its corporate payments business with full disbursement accounts payable cloud platform.

FleetCoris a cash rich company with a strong balance sheet. As of Sep 30, 2019, the company had cash, cash equivalents and restricted cash of $1.5 billion, with no long-term debt to clear-off. This significant amount of cash provides it the flexibility to pursue acquisitions and other related investments.

Cash rich companies not only guarantee protection but also reward shareholders from their deep cash balances. In third-quarter 2019, FleetCor repurchased shares worth $55 million. In 2018, 2017 and 2016, the company had repurchased shares worth $958.7 million, $402.4 million and $187.7 million, respectively.

Other Stocks to Consider

Some other top-ranked stocks in the broader Zacks Business Services sector are Global Payments GPN, Mastercard MA and Cardtronics CATM. While Global Payments sports a Zacks Rank #1, Mastercard and Cardtronics carry a Zacks Rank #2.

Long-term expected EPS (three to five years) growth rate for Global Payments, Mastercard and Cardtronics is 17%, 15.9% and 4%, respectively.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardtronics PLC (CATM) : Free Stock Analysis Report

FleetCor Technologies, Inc. (FLT) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance