Here's What Makes Akamai (AKAM) a Promising Investment Bet

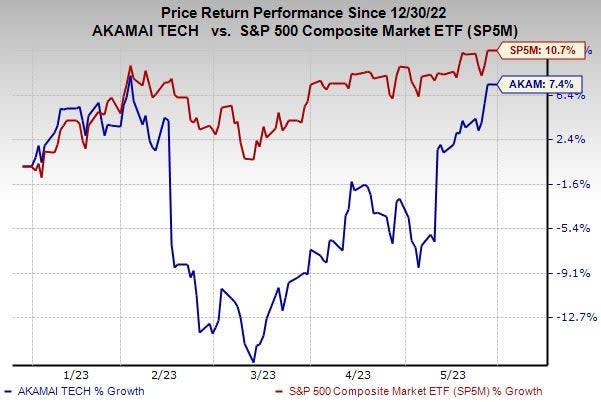

Shares of Akamai Technologies, Inc. AKAM have gained 7.4% year to date, backed by modest top-line growth and continued portfolio expansion. Earnings estimates for the current fiscal for the stock are up 5.7% since March this year, while that for the next fiscal have risen 6.3%. With healthy fundamentals, this Zacks Rank #1 (Strong Buy) stock appears to be a solid investment option for investors at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Growth Drivers

Headquartered in Cambridge, MA, Akamai is a global provider of content delivery network (CDN) and cloud infrastructure services. The company’s solutions accelerate and improve the delivery of content over the Internet, enabling faster response to requests for web pages, streaming of video & audio and business applications.

Akamai’s solutions allow customers to operate their web transactions anywhere, anytime, with cost-effective outsourced infrastructure and carry out predictable, scalable and secure e-business at low cost. These solutions are built on the Akamai Intelligent Edge Platform, which is the technological platform for its business solutions and hosts some of the world’s best-known Internet brand names.

Akamai handles approximately 2 trillion web interactions on a daily basis. Its solutions help customers to address the challenges of bandwidth constraints and Internet traffic and, at the same time, reduce the need for additional hardware to manage traffic loads. The company’s cloud optimization solutions help organizations to improve performance, increase availability and enhance the security of applications and key web assets delivered from data centers to the end user.

The buyout of Linode, a leading Infrastructure-as-a-service platform provider, has leapfrogged it as one of the world’s most distributed compute platform from cloud to edge. We believe that strong growth in demand for online media and entertainment (High-Definition video) over the Internet and gaming will drive bandwidth requirements, thereby accelerating demand for the company’s solutions in the long haul.

Cybersecurity is an area that holds a lot of promise for Akamai. With the rapid adoption of cloud computing, security has become a major concern for enterprises. Hackers are using new and sophisticated techniques to take advantage of the security loopholes of the cloud. Large enterprises are expected to increase their security budgets to efficiently address security concerns and instill confidence in cloud computing. The growing demand for Akamai’s security solutions will likely translate into significant growth opportunities over the long term. The company’s security offerings are poised to gain from higher demand for data computing at the edge, triggered by the rapid deployment of 5G and IoT devices proliferation.

The stock has a long-term earnings growth expectation of 10%. It delivered an earnings surprise of 4.9%, on average, in the trailing four quarters. With a VGM Score of B, Akamai currently appears to be an enticing investment option in this volatile market.

Other Key Picks

InterDigital, Inc. IDCC, sporting a Zacks Rank #1, delivered an earnings surprise of 170.89%, on average, in the trailing four quarters. In the last reported quarter, it pulled off an earnings surprise of 579.03%. It has a long-term earnings growth expectation of 13.9%.

It is a pioneer in advanced mobile technologies that enables wireless communications and capabilities. The company engages in designing and developing a wide range of advanced technology solutions, which are used in digital cellular and wireless 3G, 4G and IEEE 802-related products and networks.

Viasat Inc. VSAT, sporting a Zacks Rank #1, enjoys a leading position in the satellite and wireless communications market. Headquartered in Carlsbad, CA, it designs, develops and markets advanced digital satellite telecommunications and other wireless networking and signal processing equipment. The company serves its high-bandwidth, high-performance communications solutions to public as well as military, enterprises and government enterprises.

Viasat is ramping up investments in the development of its revolutionary ViaSat-3 broadband communications platform, which will have nearly 10 times the bandwidth capacity of ViaSat-2. These satellites will be capable of covering one-third of the world, including all Americas.

IHS Holding Limited IHS, carrying a Zacks Rank #2 (Buy), is another key pick. Based in London, the United Kingdom, it is one of the largest independent owners, operators and developers of shared communications infrastructure in the world by tower count.

IHS Holding has more than 39,000 towers across 11 markets — Brazil, Cameroon, Colombia, Egypt, Kuwait, Nigeria, Peru, Rwanda, South Africa and Zambia. The stock has gained 60.7% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Viasat Inc. (VSAT) : Free Stock Analysis Report

IHS Holding Limited (IHS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance