Here's How Kroger (KR) is Strengthening Position in Industry

The Kroger Co. KR, which operates in the thin-margin grocery industry, has been undergoing a complete makeover with respect to products and how consumers prefer shopping. The company has been adding new products as well as eyeing technological expansion to enhance its omnichannel reach.

Kroger has been making significant investments to enhance product freshness and quality and expand digital capabilities. The company has been introducing new items under its “Our Brands” portfolio. It launched 170 new items under this banner in the second quarter of fiscal 2022. Identical sales without fuel rose 5.8% during the quarter, while “Our Brands” identical sales rose 10.2%.

We note that Kroger’s digital business remains one of its key growth drivers, thanks to Kroger Delivery Now, the Boost membership program and the rollout of customer fulfillment centers. The company’s ‘Kroger Delivery Now’ service provides customers with food and household staples in 30 minutes. Additionally, Kroger has been expanding its customer fulfillment centers to ensure efficient deliveries.

During the second quarter, a new Kroger Delivery Customer Fulfillment Center was opened in Romulus, Michigan. Management expanded the Kroger Delivery network by opening seven new spoke facilities, which serve as last-mile cross-dock locations, including Louisville, Nashville, and Chicago in existing geographies, as well as Austin, Birmingham, Oklahoma City, and San Antonio in new geographies. A new Kroger Delivery Customer Fulfillment Center was announced in the Denver Metro area.

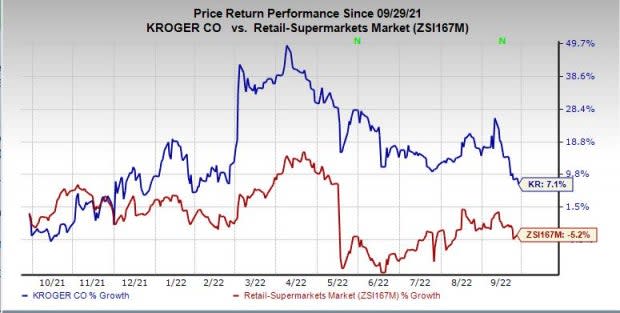

Image Source: Zacks Investment Research

Wrapping Up

We believe that Kroger’s focus on fresh offerings, technology and process improvements to lower costs, seamless digital ecosystem and margin-rich alternative profit business should continue contributing to growth. Management believes that Kroger’s Leading with Fresh and Accelerating with Digital initiatives should help generate sustainable total shareholder returns of 8-11% over time.

Kroger envisions identical sales, without fuel, to be up 4-4.5% in fiscal 2022 compared with the 0.2% growth registered in fiscal 2021. The company anticipates the FIFO operating profit in the band of $4.6-$4.7 billion compared with $4.3 billion reported in fiscal 2021. Kroger anticipates fiscal 2022 earnings between $3.95 and $4.05 per share, suggesting an increase from adjusted earnings of $3.68 reported in fiscal 2021.

Shares of this Zacks Rank #2 (Buy) have risen 7.1% in the past year against the industry’s decline of 5.2%.

3 More Stocks You May Bet On

We have highlighted three more top-ranked stocks, namely Dillard's DDS, Ulta Beauty ULTA and Arhaus ARHS.

Dillard's, which operates retail department stores, sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of nearly 215%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dillard's current financial-year sales suggests growth of nearly 4.8% from the year-ago period.

Ulta Beauty, which operates as a retailer of beauty products, sports a Zacks Rank #1. Ulta Beauty has a trailing four-quarter earnings surprise of 32.8%, on average. ULTA has an expected EPS growth rate of 11.9% for three to five years.

The Zacks Consensus Estimate for Ulta Beauty’s current financial-year sales suggests growth of 13.7% from the year-ago reported number.

Arhaus, which operates as a lifestyle brand and a premium retailer, currently carries a Zacks Rank #2. ARHS has an expected EPS growth rate of 14.3% for three to five years.

The Zacks Consensus Estimate for Arhaus’ current financial-year revenues and EPS suggests growth of 49.2% and 5.8%, respectively, from the year-ago reported figures. ARHS has a trailing four-quarter earnings surprise of 92%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dillard's, Inc. (DDS) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Ulta Beauty Inc. (ULTA) : Free Stock Analysis Report

Arhaus, Inc. (ARHS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance