Here's How BJ's Wholesale (BJ) Looks Ahead of Q2 Earnings

BJ's Wholesale Club Holdings, Inc. BJ is likely to register an increase in the top line when it reports second-quarter fiscal 2022 results on Aug 18 before market open. The Zacks Consensus Estimate for revenues is pegged at $4.70 billion, indicating growth of 12.5% from the prior-year reported figure.

The bottom line of this operator of membership warehouse clubs is anticipated to have remained flat year over year at 82 cents. The consensus estimate has risen by a couple of cents over the past seven days. The company has a trailing four-quarter earnings surprise of 16.1%, on average. In the last reported quarter, this Westborough-based company’s bottom line surpassed the Zacks Consensus Estimate by a margin of 19.2%.

We expect total revenues to be up 10.3% year over year to $4,607.8 million and the bottom line to decline 3.3% to 79 cents a share.

Factors to Note

BJ's Wholesale’s focus on simplifying assortments, boosting marketing and merchandising capabilities, expanding into high-demand categories and building an own-brands portfolio is commendable. The company remains committed to enhancing omnichannel capabilities and providing value for customers. These endeavors have been contributing to growth in membership signups and renewals.

The company has been directing resources toward expanding digital capabilities to better engage with members and provide them with a convenient way to shop, including same-day delivery, curbside pickup and buy-online, pickup in-club. Management believes that digitally engaged members have higher average baskets and make more trips per year than members who shop in-club only. Also, the company’s acquisition of the perishable supply chain from Burris Logistics puts it in an advantageous position to scale up supply-chain capabilities and expand fresh food offerings

Thus, BJ's Wholesale’s better pricing, private label offerings, merchandise initiatives and digital solutions are likely to have favorably impacted the to-be-reported quarter’s performance. We expect total comparable club sales to increase 7%. Excluding the expected contribution of 3% from gasoline sales, we expect comparable club sales to improve 4%. However, margins remain an area to watch. The rising cost pressure amid logistics bottlenecks, tight labor market and material shortages might have weighed on margins.

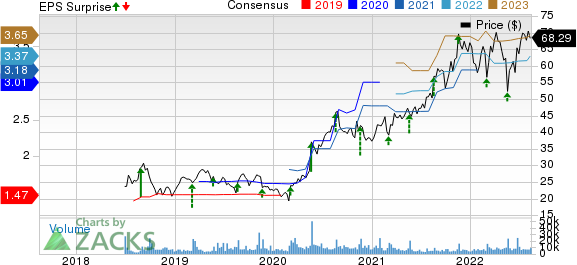

BJ's Wholesale Club Holdings, Inc. Price, Consensus and EPS Surprise

BJ's Wholesale Club Holdings, Inc. price-consensus-eps-surprise-chart | BJ's Wholesale Club Holdings, Inc. Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for BJ's Wholesale Club this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here.

BJ's Wholesale Club has an Earnings ESP of +11.15% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

3 More Stocks With the Favorable Combination

Here are three other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Dollar General DG currently has an Earnings ESP of +0.99% and a Zacks Rank of 2. The company is likely to register an increase in the bottom line when it reports second-quarter fiscal 2022 results. The Zacks Consensus Estimate for quarterly earnings has risen by a couple of cents over the past 30 days to $2.92 per share. The consensus mark for DG’s earnings per share suggests 8.6% growth from the year-ago quarter’s reported number. You can see the complete list of today’s Zacks #1 Rank stocks here.

Dollar General’s top line is expected to have risen year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $9.38 billion, which suggests a rise of 8.4% from the figure reported in the prior-year quarter. DG delivered an earnings beat of 2.8%, on average, in the trailing four quarters.

Ollie's Bargain OLLI currently has an Earnings ESP of +6.06% and a Zacks Rank #2. The company is expected to register a bottom-line decline when it reports second-quarter fiscal 2022 results. The Zacks Consensus Estimate for quarterly earnings per share of 33 cents suggests a decline from the 52 cents reported in the year-ago quarter.

Ollie's Bargain’s top line is anticipated to have risen year over year. The consensus mark for OLLI’s revenues is pegged at $457.5 million, indicating an increase of 10% from the figure reported in the year-ago quarter.

The Children's Place PLCE currently has an Earnings ESP of +1.03% and a Zacks Rank #3. The company is likely to register a bottom-line decline when it reports second-quarter fiscal 2022 numbers. The Zacks Consensus Estimate for quarterly earnings per share of 97 cents suggests a decline of 43.3% from the year-ago quarter.

The Children's Place's top line is expected to have declined year over year. The Zacks Consensus Estimate for quarterly revenues is pegged at $395.6 million, which indicates a decline of 4.4% from the figure reported in the prior-year quarter. PLCE has a trailing four-quarter earnings surprise of 58%, on average.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar General Corporation (DG) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

The Children's Place, Inc. (PLCE) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance