Here’s what Apple’s China nightmare scenario looks like

Apple (AAPL) unexpectedly slashed its revenue forecast for the fiscal first quarter of 2019 on Wednesday, citing weakness in China and lower-than-anticipated iPhone revenue.

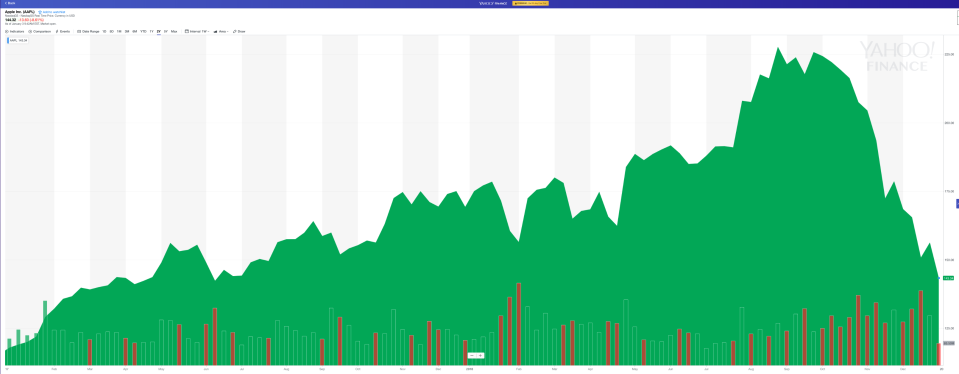

The move confirmed investors’ biggest fear — a slowing global economy further hindered by the U.S.-China trade war — and the stock plunged more than 8% in early trading on Thursday.

The stark acknowledgment from the premier U.S. tech company is sending reverberations throughout global markets and even led Citi to ask an existential question: “What if China Sales Went to Zero?”

Noting that China represented 18% of total sales for Apple last quarter, Citi analysts presented the nightmare scenario:

“We estimate if China sales went to zero that would reduce iPhone units by -44m and approximately ~$20-$30 per share in Apple stock price,” the note stated. “While we don’t expect zero sales to occur we believe investors will value this framework and the scenario analysis in this report.”

Apple ended Wednesday’s session with a share price of $157.92, which was already a 30% decline from an all-time high of $227.63 on August 27. Amid Apple’s problems in China, the Dow fell more than 300 points in early trading on Thursday.

The company is expected to report results for the fiscal first quarter of 2019 after market close on January 29.

Follow Michael on Twitter.

READ MORE:

What Tim Cook left out about China in Apple’s revenue guidance

Origin story: Apple’s journey from Steve Jobs’ garage to $1,000,000,000,000

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance