Helmerich & Payne (HP) Q4 Earnings Beat, Sales Miss Mark

Helmerich & Payne Inc. HP recently released fourth-quarter fiscal 2019 results wherein it delivered a comprehensive earnings beat on the back of improved contribution from the H&P Technologies business, which benefited from a change in contingent liability accounting.

The company posted adjusted quarterly earnings of 39 cents a share, surpassing the Zacks Consensus Estimate of 24. The bottom line also improved from the year-ago figure of 19 cents.

However, operating revenues of $649.05 million lagged the Zacks Consensus Estimate of $661 million and also decreased 6.8% from the year-ago level of $696.83 million. This underperformance can be attributed to weak contributions from the U.S. Land and International land segments.

Segmental Performance

U.S. Land: During the quarter, operating revenues totaled $545 million, down 6.8% year over year as average rig expense per day rose 9.7% to $15,440.

The average rig margin per day dipped 2.2% from the prior-year quarter to $10,038. Moreover, revenue days dropped in the quarter under review. However, rig utilization soared 68% compared with the year-ago level of 65%. The segment’s operating profit came in at $59.2 million compared with the year-ago profit of $63 million.

Offshore: Revenues came in at $38.4 million, almost unchanged from the year-ago quarter. While rig utilization and revenue days were in line with the year-ago level, higher average rig expenses per day and increased direct operating expenses diminished the segment’s operating profits.

Although daily average rig revenues increased 18.25% from the year-ago figure, rig expense per day surged 42.6%. However, the average rig margin per day plunged 34.8% year over year to $7,460, missing the Zacks Consensus Estimate of $12,500. In addition, segmental profits declined to $2.8 million from $7.7 million in the prior-year quarter.

International Land: Operations generated revenues of $48.3 million, down from $59.3 million in the prior-year quarter on lower average rig revenue per day.

While rig utilization increased to 56%, average rig revenue and rig margin per day decreased 8.7% and 36.7% from the year-ago quarter to $28,199 and $5,477, respectively. Selling, general and administrative charges of 1,399 million weighed on the segment’s bottom line as well, inducing an operating loss of $4.2 million, narrower than the $7.6 million loss in the year-ago period.

H&P Technologies: In late last November, Helmerich & Payne had announced the creation of its new segment ‘H&P Technologies’ to reflect the addition of the recently-acquired rig technology companies to its portfolio, namely MagVar and Motive Drilling along with Angus Jamieson Consulting, an industry leader in wellbore positioning.

Courtesy of strong demand during the quarter, the segment recognized revenues of $13.8 million, up 26.8% from the year-ago figure. However, higher revenues were partly offset by increasing selling, general and administrative charges and depreciation. But overall, the segment generated operating profit of $623 million against the year-ago loss of $14 million.

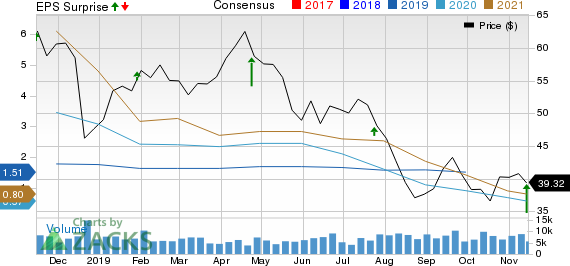

Helmerich & Payne, Inc. Price, Consensus and EPS Surprise

Helmerich & Payne, Inc. price-consensus-eps-surprise-chart | Helmerich & Payne, Inc. Quote

Capital Expenditure & Balance Sheet

In the reported quarter, Helmerich & Payne spent $54.8 million on capital programs. As of Sep 30, 2019, the company had $347.9 million in cash and cash equivalents while long-term debt was $479.3 million (debt-to-capitalization ratio of 10.6%).

Guidance

This Tulsa, OK-based company expects activity in the U.S. land segment to decrease 5.5-6.5% sequentially during first-quarter fiscal 2020. While average rig revenue per day is likely to be in the band of $24,750-$25,250, daily average rig cost is expected within $14,350-$14,850.

Coming to the offshore segment, Helmerich & Payne projects average rig margin per day within $12,000-$13,000 in the fiscal first quarter and revenue days to fall 15% sequentially.

Moreover, international land segment revenue days will likely witness a slight decrease sequentially. Average rig margin per day is anticipated within $3,00-$4,000.

Revenues from HP Technologies are predicted in the $15-$18 million range.

For fiscal 2020, Helmerich & Payne estimates capital outlay within $275-$300 million.

Zacks Rank & Key Picks

Helmerich & Payne currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the energy space are NuStar Energy L.P. NS, Phillips 66 PSX and World Fuel Services Corporation INT, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

World Fuel Services Corporation (INT) : Free Stock Analysis Report

Helmerich & Payne, Inc. (HP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance