Helen of Troy (HELE) Down More Than 45% in 6 Months: Here's Why

Helen of Troy Limited HELE is facing escalated cost inflation, which has been marring its margin performance for a while. The company is battling supply chain-related issues. Escalated selling, general and administration (SG&A) expenses are a hurdle for this consumer products player. These factors hurt HELE’s first-quarter fiscal 2023 results, with the top and the bottom line declining year over year.

Recently, management lowered its fiscal 2022 guidance. We note that the Zacks Consensus Estimate for fiscal 2022 earnings has moved down by 1% in the past 30 days to $10.08 per share. The projection indicates a decline of 18.5% from the year-ago period’s reported figure.

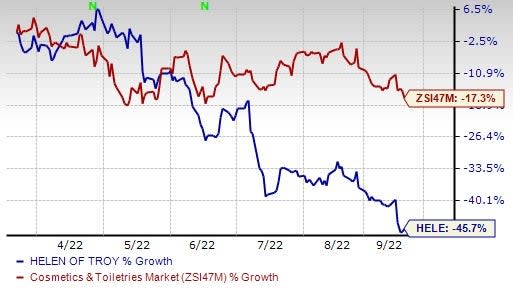

Shares of the Zacks Rank #4 (Sell) stock have plunged 45.7% in the past six months compared with the industry’s 17.3% decline.

Let’s discuss.

Image Source: Zacks Investment Research

Lowered View

During its first-quarter fiscal 2023 earnings release, management lowered fiscal 2023 sales and earnings guidance to reflect the impact of headwinds like a shift in consumer buying patterns, inflation, supply-chain disruptions, unfavorable currency rates and rising interest rates. Helen of Troy anticipates fiscal 2023 consolidated net sales between $2.15 billion and $2.20 billion, suggesting a decline of 3.3%-1% and a Core business decline of 1.8-0.5%. Management anticipated consolidated net sales between $2.38 billion and $2.42 billion, indicating consolidated growth of 6.8-8.8% and a Core business increase of 8.5-10.5%.

The company now expects fiscal 2023 adjusted earnings per share (EPS) in the range of $9.85-$10.35. This indicates the consolidated adjusted EPS decline of 20.3-16.3% and the Core adjusted EPS drop of 19.2-15.1%. Earlier, management had expected consolidated adjusted EPS in the range of $12.73-$13.03, indicating a consolidated adjusted EPS increase of 3.0-5.4% and the Core adjusted EPS increase of 4.5-7.0%.

Margin Pressure

During the first quarter of fiscal 2023, Helen of Troy's adjusted operating margin fell 3.9 percentage points to 13.6%. The downside was caused by unfavorable operating leverage and increased marketing expenses. The adverse impact of reduced Beauty unit sales in the consolidated net sales revenue and the net diluted impact of inflationary expenses and related customer price hikes were also headwinds. Adjusted operating margin decreased across all segments during the quarter.

Higher SG&A Costs Hurt

Helen of Troy has been grappling with rising SG&A costs for a while. During first-quarter fiscal 2023, the company’s SG&A expense came in at $177.2 million, up from $155.8 million reported in the year-ago quarter. The consolidated SG&A expense ratio increased 6.1 percentage points to 34.9% due to increased personnel expenses, higher marketing costs and greater distribution expenses. Increased share-based compensation expenses and acquisition-related costs, among others, also hurt the metric.

Final Thoughts

Helen of Troy is focused on making solid investments in its Leadership Brands, a market-leading portfolio of brands. The company is on track to invest in consumer-centric innovation, enhanced production and distribution capacity and direct-to-consumer channels. It expects to create further value through strategic acquisitions. In addition, HELE is undertaking cost savings endeavors amid rising inflation and supply chain disruptions.

That being said, let’s see if these upsides can help HELE counter the aforementioned hurdles.

Stocks to Consider

Some better-ranked stocks are Inter Parfums IPAR, e.l.f. Beauty ELF and Celsius Holdings CELH.

Inter Parfums is engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products. IPAR currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial year sales and EPS suggests growth of 15% and 18.6%, respectively, from the year-ago period’s reported figures. IPAR has a trailing four-quarter earnings surprise of 31.1%, on average.

e.l.f. Beauty, a cosmetic company, currently has a Zacks Rank #2 (Buy). ELF has a trailing four-quarter earnings surprise of almost 77%, on average.

The Zacks Consensus Estimate for e.l.f. Beauty’s current financial-year sales and EPS suggests growth of 16.8% and 4.8%, respectively, from the year-ago period’s reported figures.

Celsius Holdings, which develops, processes, markets, distributes and sells functional drinks and liquid supplements, carries a Zacks Rank #2 at present. Celsius Holdings delivered an earnings surprise of 118.8% in the last reported quarter.

The Zacks Consensus Estimate for CELH’s current financial year sales suggests growth of 97.3% from the year-ago period’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance