HEICO (HEI) Q2 Earnings Beat Estimates, Sales Increase Y/Y

HEICO Corporation’s HEI second-quarter fiscal 2023 earnings per share of 76 cents beat the Zacks Consensus Estimate of 72 cents by 5.6%. The bottom line also improved 22.6% from the prior-year period’s 62 cents.

Total Sales

The company’s net sales increased 28% year over year to $687.8 million in the reported quarter, primarily driven by an improvement in the commercial aerospace market. Total sales also beat the Zacks Consensus Estimate of $654 million by 5.1%.

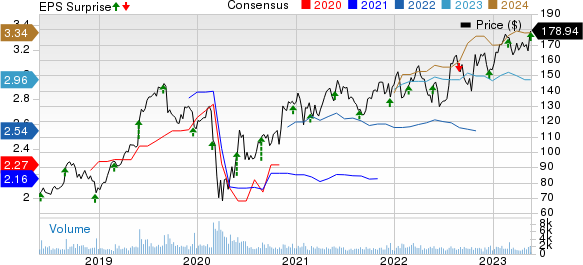

Heico Corporation Price, Consensus and EPS Surprise

Heico Corporation price-consensus-eps-surprise-chart | Heico Corporation Quote

Operational Update

HEICO’s total costs and expenses increased 27.6% year over year to $530.8 million in the quarter under review. The rise was due to the higher cost of sales and SG&A expenses.

Segmental Performance

Flight Support Group: Net sales surged 28% year over year to $392.2 million. This hike was driven by the increased demand for the majority of its commercial aerospace products and services, resulting from continued recovery in global commercial air travel.

The operating income soared 51% year over year to $99.9 million. This increase was due to solid net sales growth, an improved gross profit margin and the impact of the amendment and termination of a contingent consideration agreement. Further, its operating margin expanded by a massive 390 basis points (bps) to 25.5% compared with 21.6% in the prior-year period.

Electronic Technologies Group: The segment’s net sales increased 27% to $301.8 million, primarily due to the increased demand for its products and net sales contributions from the recent acquisition of Exxelia.

The segment’s operating income improved 3% year over year to $68 million, primarily driven by higher net sales volumes. The company’s operating margin contracted by 530 bps to 22.5%.

Financial Details

As of Apr 30, 2023, HEI’s cash and cash equivalents totaled $127.2 million compared with $139.5 million as of Oct 31, 2022.

Cash flow provided by operating activities was $154.4 million during the six months preceding Jan 31, 2023, highlighting an 11.6% decline from the prior-year period.

HEICO reported long-term debt (net of current maturities) of $735.8 million as of Apr 30, 2023, up from $288.6 million as of Oct 31, 2022.

Zacks Rank

HEICO currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Textron Inc. TXT reported first-quarter 2023 adjusted earnings of $1.05 per share, which surpassed the Zacks Consensus Estimate of 95 cents by 10.5%. The bottom line also improved by 8.2% from the year-ago quarter’s figure.

Total revenues came in at $3,024 million, which missed the Zacks Consensus Estimate of $3,078 million by 1.8%. However, the reported figure increased 0.8% from the year-ago quarter’s $3,001 million.

Hexcel Corporation HXL reported first-quarter 2023 adjusted earnings of 50 cents per share, which beat the Zacks Consensus Estimate of 39 cents by 28.2%. The bottom line improved massively from the year-ago earnings of 22 cents per share, highlighting solid growth of 127.3%.

In the quarter under review, the company posted GAAP earnings of 50 cents per share compared with the prior-year quarter’s earnings of 21 cents.

Lockheed Martin Corporation LMT reported first-quarter 2023 adjusted earnings of $6.43 per share, which surpassed the Zacks Consensus Estimate of $6.07 by 5.9%. However, the bottom line was in line with the year-ago quarter's figure.

Net sales amounted to $15.13 billion in the reported quarter, which surpassed the Zacks Consensus Estimate of $14.87 billion by 1.9%. The top line rose 1.1% from $14.96 billion in the year-ago quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Heico Corporation (HEI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance