Do Hedge Funds Love RPC, Inc. (RES)?

At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards RPC, Inc. (NYSE:RES) at the end of the first quarter and determine whether the smart money was really smart about this stock.

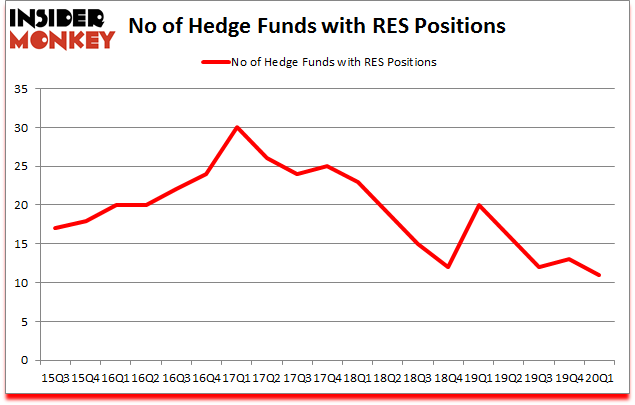

Is RPC, Inc. (NYSE:RES) a buy right now? Money managers were reducing their bets on the stock. The number of bullish hedge fund positions decreased by 2 lately. Our calculations also showed that RES isn't among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey's monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That's why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

[caption id="attachment_30621" align="aligncenter" width="400"]

Cliff Asness of AQR Capital Management[/caption]

At Insider Monkey we scour multiple sources to uncover the next great investment idea. There is a lot of volatility in the markets and this presents amazing investment opportunities from time to time. For example, this trader claims to deliver juiced up returns with one trade a week, so we are checking out his highest conviction idea. A second trader claims to score lucrative profits by utilizing a "weekend trading strategy", so we look into his strategy's picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller's investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now we're going to review the latest hedge fund action surrounding RPC, Inc. (NYSE:RES).

What does smart money think about RPC, Inc. (NYSE:RES)?

Heading into the second quarter of 2020, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from the previous quarter. On the other hand, there were a total of 20 hedge funds with a bullish position in RES a year ago. So, let's examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey's hedge fund database, GAMCO Investors, managed by Mario Gabelli, holds the largest position in RPC, Inc. (NYSE:RES). GAMCO Investors has a $5.8 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, holding a $3.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish encompass David Harding's Winton Capital Management, Ken Griffin's Citadel Investment Group and John Overdeck and David Siegel's Two Sigma Advisors. In terms of the portfolio weights assigned to each position GAMCO Investors allocated the biggest weight to RPC, Inc. (NYSE:RES), around 0.07% of its 13F portfolio. Winton Capital Management is also relatively very bullish on the stock, earmarking 0.05 percent of its 13F equity portfolio to RES.

Seeing as RPC, Inc. (NYSE:RES) has witnessed falling interest from the smart money, we can see that there were a few hedgies that slashed their entire stakes by the end of the first quarter. It's worth mentioning that Dmitry Balyasny's Balyasny Asset Management dropped the biggest stake of all the hedgies followed by Insider Monkey, worth an estimated $1.5 million in stock. Ken Fisher's fund, Fisher Asset Management, also dumped its stock, about $0.5 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 2 funds by the end of the first quarter.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as RPC, Inc. (NYSE:RES) but similarly valued. We will take a look at Provention Bio, Inc. (NASDAQ:PRVB), National Energy Services Reunited Corp. (NASDAQ:NESR), China Yuchai International Limited (NYSE:CYD), and HarborOne Bancorp, Inc. (NASDAQ:HONE). This group of stocks' market caps resemble RES's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position PRVB,8,38816,-1 NESR,5,17598,-3 CYD,6,50209,0 HONE,12,28959,-1 Average,7.75,33896,-1.25 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $34 million. That figure was $15 million in RES's case. HarborOne Bancorp, Inc. (NASDAQ:HONE) is the most popular stock in this table. On the other hand National Energy Services Reunited Corp. (NASDAQ:NESR) is the least popular one with only 5 bullish hedge fund positions. RPC, Inc. (NYSE:RES) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still beat the market by 15.5 percentage points. Hedge funds were also right about betting on RES as the stock returned 49.5% in Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Get real-time email alerts: Follow Rpc Inc (NYSE:RES)

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

Yahoo Finance

Yahoo Finance