Health Check: How Prudently Does Noble (NYSE:NE) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Noble Corporation plc (NYSE:NE) does use debt in its business. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Noble

What Is Noble's Net Debt?

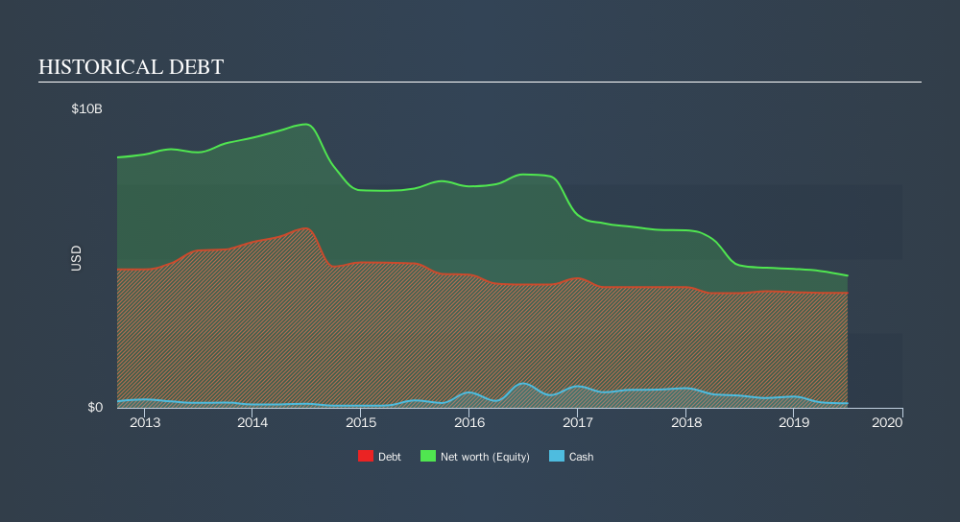

The chart below, which you can click on for greater detail, shows that Noble had US$3.85b in debt in June 2019; about the same as the year before. However, it also had US$153.8m in cash, and so its net debt is US$3.70b.

How Healthy Is Noble's Balance Sheet?

The latest balance sheet data shows that Noble had liabilities of US$734.8m due within a year, and liabilities of US$3.90b falling due after that. Offsetting these obligations, it had cash of US$153.8m as well as receivables valued at US$270.2m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$4.21b.

The deficiency here weighs heavily on the US$488.4m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt At the end of the day, Noble would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Noble's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Noble managed to grow its revenue by 4.4%, to US$1.1b. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, Noble had negative earnings before interest and tax (EBIT), over the last year. Its EBIT loss was a whopping US$76m. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it burned through US$161m in the last year. So we consider this a high risk stock, and we're worried its share price could sink faster than than a dingy with a great white shark attacking it. For riskier companies like Noble I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance