If You Had Bought Titan International (NYSE:TWI) Stock Five Years Ago, You'd Be Sitting On A 73% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Titan International, Inc. (NYSE:TWI) for half a decade as the share price tanked 73%. And it's not just long term holders hurting, because the stock is down 57% in the last year. Shareholders have had an even rougher run lately, with the share price down 21% in the last 90 days.

See our latest analysis for Titan International

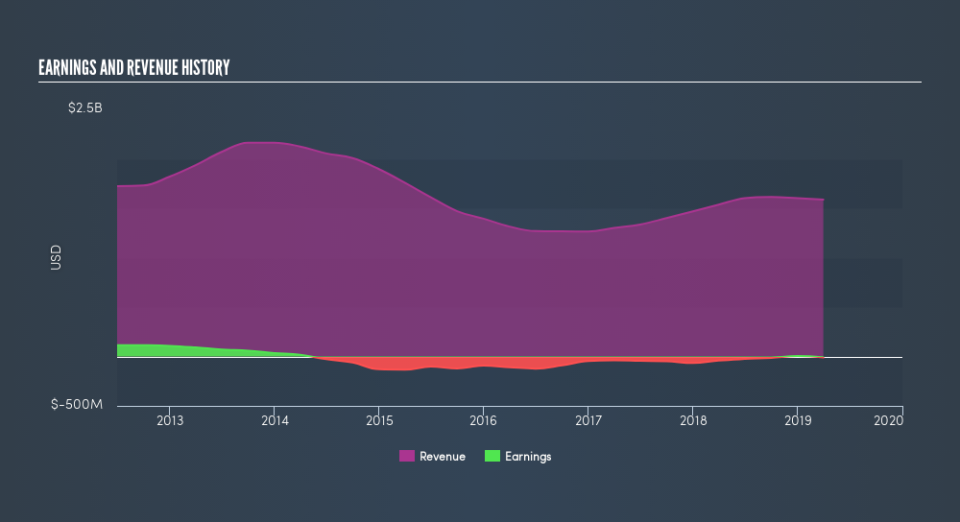

Titan International isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Titan International reduced its trailing twelve month revenue by 5.7% for each year. That's not what investors generally want to see. The share price fall of 23% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Titan International

A Different Perspective

While the broader market gained around 6.9% in the last year, Titan International shareholders lost 57% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 23% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Titan International is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance