If You Had Bought Point Loma Resources (CVE:PLX) Stock A Year Ago, You'd Be Sitting On A 67% Loss, Today

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held Point Loma Resources Ltd. (CVE:PLX) over the last year knows what a loser feels like. To wit the share price is down 67% in that time. Even if you look out three years, the returns are still disappointing, with the share price down (the share price is down 56%) in that time. The falls have accelerated recently, with the share price down 39% in the last three months.

See our latest analysis for Point Loma Resources

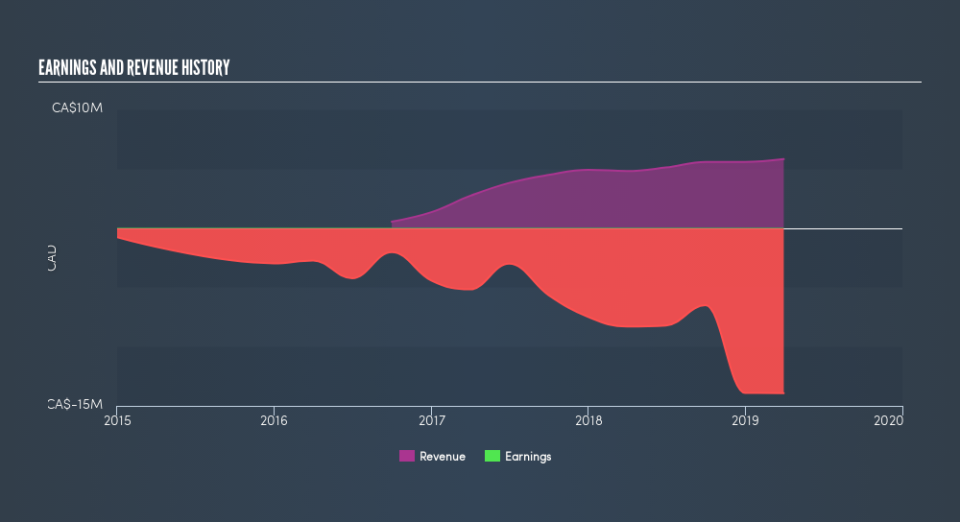

Point Loma Resources isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Point Loma Resources grew its revenue by 21% over the last year. We think that is pretty nice growth. Meanwhile, the share price tanked 67%, suggesting the market had much higher expectations. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. It might be well worthwhile taking a look at our free report on Point Loma Resources's earnings, revenue and cash flow.

A Different Perspective

Point Loma Resources shareholders are down 67% for the year, but the broader market is up 1.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 24% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Point Loma Resources by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance