If You Had Bought PagSeguro Digital (NYSE:PAGS) Stock A Year Ago, You Could Pocket A 65% Gain Today

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the PagSeguro Digital Ltd. (NYSE:PAGS) share price is up 65% in the last year, clearly besting the market return of around 6.7% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for PagSeguro Digital

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year PagSeguro Digital grew its earnings per share (EPS) by 43%. This EPS growth is significantly lower than the 65% increase in the share price. This indicates that the market is now more optimistic about the stock. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 52.08.

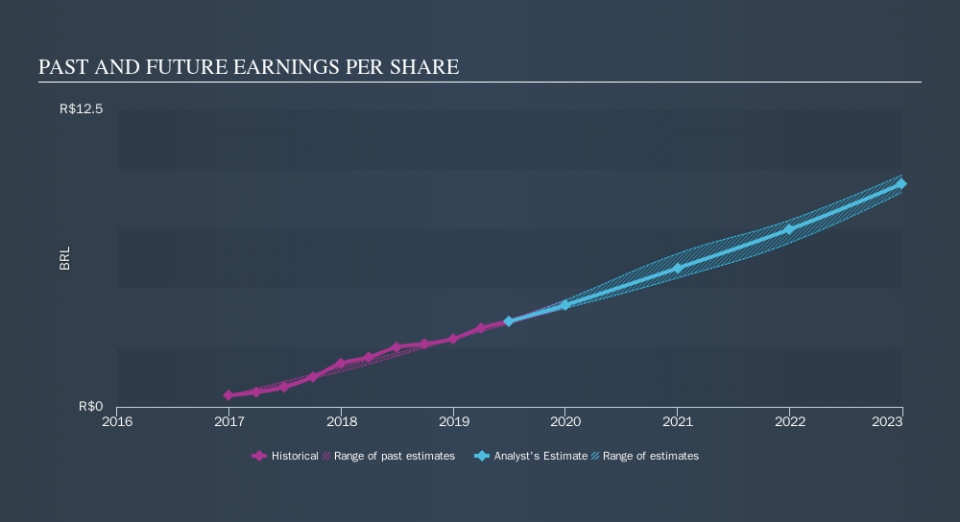

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that PagSeguro Digital has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at PagSeguro Digital's financial health with this free report on its balance sheet.

A Different Perspective

PagSeguro Digital boasts a total shareholder return of 65% for the last year. That's better than the more recent three month gain of 2.1%, implying that share price has plateaued recently. It seems likely the market is waiting on fundamental developments with the business before pushing the share price higher (or lower). Before forming an opinion on PagSeguro Digital you might want to consider these 3 valuation metrics.

But note: PagSeguro Digital may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance