If You Had Bought Corsa Coal (CVE:CSO) Stock Five Years Ago, You'd Be Sitting On A 68% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

While not a mind-blowing move, it is good to see that the Corsa Coal Corp. (CVE:CSO) share price has gained 14% in the last three months. But that doesn't change the fact that the returns over the last half decade have been disappointing. In that time the share price has delivered a rude shock to holders, who find themselves down 68% after a long stretch. So we're not so sure if the recent bounce should be celebrated. Of course, this could be the start of a turnaround.

Check out our latest analysis for Corsa Coal

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

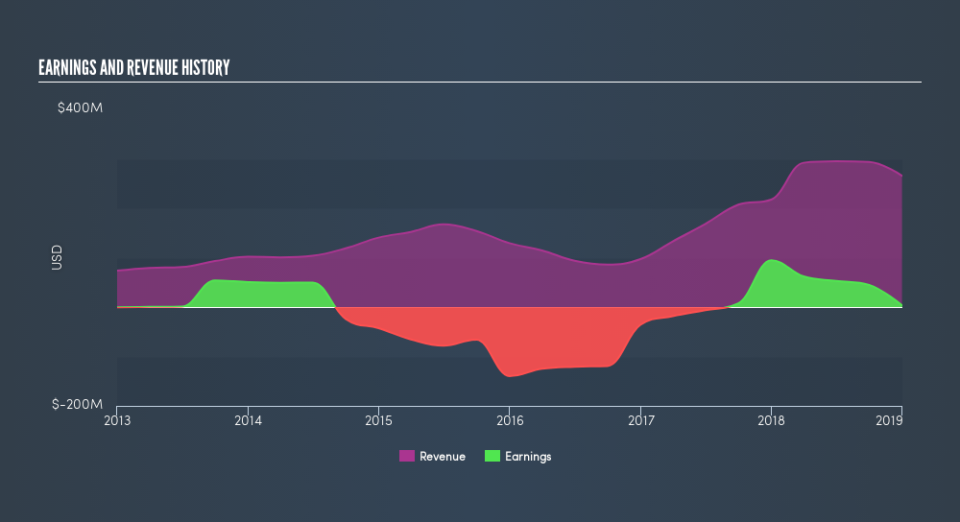

Corsa Coal became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

In contrast to the share price, revenue has actually increased by 21% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

It is of course excellent to see how Corsa Coal has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Corsa Coal had a tough year, with a total loss of 41%, against a market gain of about 6.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 20% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Before spending more time on Corsa Coal it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance