If You Had Bought Bluesky Digital Assets (CVE:BTC) Stock Three Years Ago, You'd Be Sitting On A 93% Loss, Today

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Bluesky Digital Assets Corp. (CVE:BTC); the share price is down a whopping 93% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And the ride hasn't got any smoother in recent times over the last year, with the price 91% lower in that time. Shareholders have had an even rougher run lately, with the share price down 67% in the last 90 days.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

See our latest analysis for Bluesky Digital Assets

We don't think Bluesky Digital Assets's revenue of CA$547,380 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that Bluesky Digital Assets will significantly advance the business plan before too long.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. It certainly is a dangerous place to invest, as Bluesky Digital Assets investors might realise.

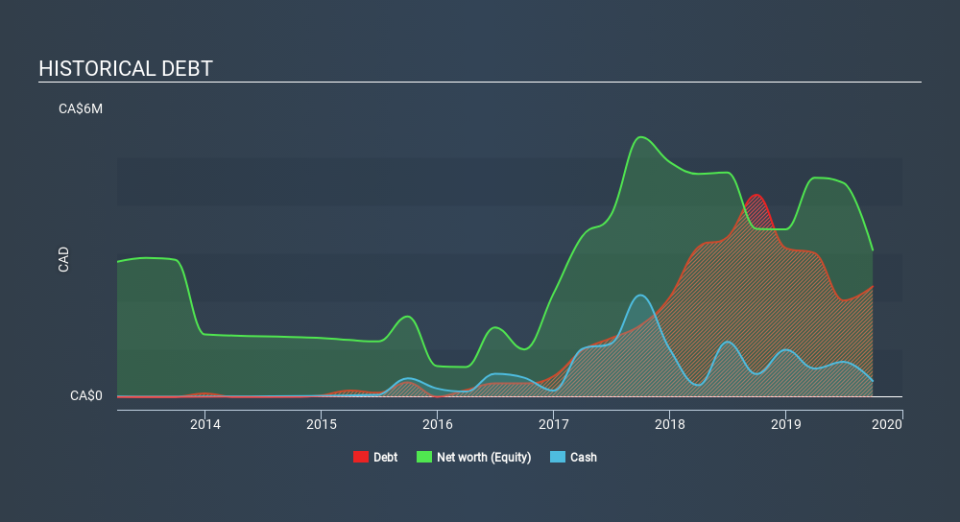

Bluesky Digital Assets had liabilities exceeding cash by CA$2.5m when it last reported in September 2019, according to our data. That puts it in the highest risk category, according to our analysis. But since the share price has dived -59% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak. You can click on the image below to see (in greater detail) how Bluesky Digital Assets's cash levels have changed over time. The image below shows how Bluesky Digital Assets's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. It only takes a moment for you to check whether we have identified any insider sales recently.

A Different Perspective

Bluesky Digital Assets shareholders are down 91% for the year, but the broader market is up 14%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 59% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Bluesky Digital Assets better, we need to consider many other factors. For instance, we've identified 5 warning signs for Bluesky Digital Assets (4 are significant) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance