Will Growth Plans Aid American Eagle (AEO) as 2022 Unfolds?

American Eagle Outfitters, Inc. AEO has been gaining from significant progress in its Real Power Real Growth value creation plan. The plan is driving profitability through real estate and inventory optimization efforts, omni-channel and customer focus, and investments to improve the supply chain. Robust consumer demand for its merchandise and brands has been aiding its performance.

Strength in the digital business is another driver. The company’s efforts to expand its omnichannel capabilities have been aiding digital sales. Driven by the trends and progress on its growth plan, American Eagle expects to deliver a robust fourth quarter and fiscal 2021. It also raised its 2023 financial targets.

The company expects to achieve an operating income of $600 million in fiscal 2021. This will help it surpass its fiscal 2023 operating income and margin goals two years ahead of schedule.

As a result, management raised the 2023 financial targets. AEO now expects revenues of $5.8 billion, up from earlier mentioned $5.5 billion. The operating income is estimated to be $800 million, with the operating margin expanding to 13.5% by 2023. Previously, the operating income and the operating margin were anticipated to be $550 million and 10%, respectively. The revised view doesn’t include asset impairment and restructuring charges.

The company expects revenues for the Aerie brand to reach $2.2 billion by 2023, seeing more than a 20% compound annual growth rate compared with fiscal 2019. The American Eagle brand is also envisioned to grow slightly from fiscal 2019, with $3.6 billion in revenues.

American Eagle updated the fourth-quarter fiscal 2021 view as well, which suggests gains from solid demand and pricing actions. It anticipates fourth-quarter revenue growth in a mid-to-high teens range on a year-over-year basis and mid-teens growth on a two-year basis. The operating income is likely to be $90-$100 million, inclusive of freight expenses of $80 million stemming from supply-chain disruptions.

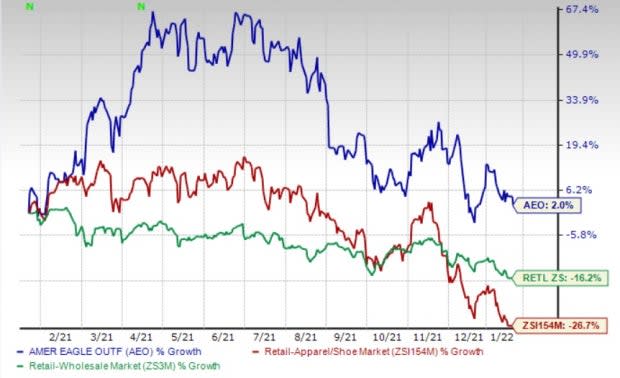

Shares of the Zacks Rank #3 (Hold) company have gained 2% in a year against the industry’s and the sector’s declines of 26.7% and 16.2%, respectively.

Image Source: Zacks Investment Research

What’s More?

As part of the Real Power Real Growth plan, American Eagle will continue to pursue opportunities to grow the Aerie brand through expansion into newer markets, innovation and a growing customer base. The company’s efforts under the plan have aided the recovery of the American Eagle brand. Going forward, it expects to undertake initiatives to deliver growth and sustained profitability for the American Eagle brand.

American Eagle has been witnessing spectacular growth for its Aerie brand for quite some time now. The brand has been witnessing momentum across all categories, particularly in its new activewear brand OFFLINE. Robust demand in the legging business, which is one of its best margin categories, along with strength in core intimates bralettes and apparel, bodes well. Aerie’s recently launched integrated marketing campaign, named Voices of AerieREAL, looks encouraging.

The company is also focused on enhancing the supply chain under the aforementioned plan. Its recent acquisitions of Quiet Logistics and AirTerra to offer affordable same-day and next-day delivery services bode well. The buyouts will not only transform the supply chain but also help expand AEO’s customer base as well as drive growth, particularly in its online channel.

Stocks to Consider

We have highlighted three better-ranked companies in the Retail - Wholesale sector, namely Capri Holdings CPRI, Designer Brands DBI and Tilly's TLYS.

Capri Holdings, which operates membership warehouses, presently carries a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 1024.9%, on average. Shares of CPRI have rallied 31% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Capri Holdings’ sales and EPS for the current financial year suggests respective growth of 33.2% and 181.1% from the year-ago period’s reported figures. CPRI has an expected EPS growth rate of 32.2% for three to five years.

Designer Brands, a retailer of footwear and accessories in North America, currently flaunts a Zacks Rank #1. Shares of DBI have gained 48.9% in the past year.

The Zacks Consensus Estimate for Designer Brands’ fiscal 2022 sales and earnings suggests growth of 43.8% and 143.1%, respectively, from the year-ago reported figure. DBI has a trailing four-quarter earnings surprise of 116%, on average.

Tilly's, a specialty retailer of casual apparel, footwear, accessories and hard goods, presently sports a Zacks Rank #1. Shares of TLYS have rallied 25% in the past year.

The Zacks Consensus Estimate for Tilly's sales for the current financial year suggests growth of 46.3% from the year-ago period’s reported figures. TLYS has a trailing four-quarter earnings surprise of 296.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Tilly's, Inc. (TLYS) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

Designer Brands Inc. (DBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance