Can Growth in Assets Aid BNY Mellon (BK) in Q4 Earnings?

The Bank of New York Mellon Corporation BK is scheduled to report fourth-quarter and 2019 results on Jan 16, before the market opens. While its quarterly revenues are expected to have increased year over year, earnings are likely to have witnessed a decline.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate. Results benefited from a decline in expenses along with growth in assets under management (AUM). However, a decline in revenues was a headwind.

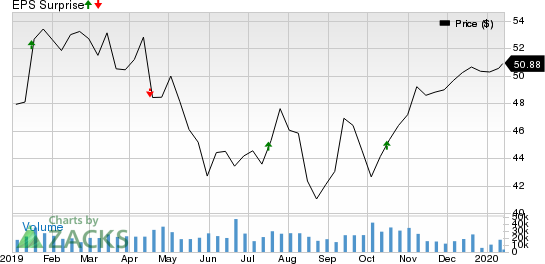

BNY Mellon has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, with a positive surprise of 5.3%, on average.

The Bank of New York Mellon Corporation Price and EPS Surprise

The Bank of New York Mellon Corporation price-eps-surprise | The Bank of New York Mellon Corporation Quote

However, activities of the company in the fourth quarter were not adequate to win analysts’ confidence. As a result, the Zacks Consensus Estimate for earnings of 98 cents has been unchanged over the past 30 days. Moreover, it indicates a decline of 1% from the year-ago reported number.

The Zacks Consensus Estimate for sales for the to-be-reported quarter is pegged at $4.68 billion, indicating 16.1% growth from the prior-year quarter’s reported figure.

Key Estimates for Q4

The Zacks Consensus Estimate for fourth-quarter AUM is pegged at $1.97 trillion, which indicates 4.7% growth from the previous quarter’s reported figure. Moreover, the consensus estimate for total assets under custody and administration of $37.22 trillion suggests growth of nearly 4% from the prior quarter’s reported figure. Thus, driven by expected growth in assets, investment management and performance fee is likely to have been positively impacted in the quarter.

However, the consensus estimate for total investment services fee of $1.98 billion indicates a decline of 2.7% from the previous quarter’s reported number.

Total fee revenues are also expected to have declined in the fourth quarter. The consensus estimate for fee revenues is pegged at $3.09 billion, suggesting a 1.2% decline sequentially.

Notably, the lending scenario was not very good in the fourth quarter. Thus, soft loan growth along with a decline in interest rates is likely to have hurt BNY Mellon’s net interest revenue (NIR) growth.

Management projects NIR in the fourth quarter to decline 4-6% sequentially. This is based on expectations of a decrease in the yield on the securities portfolio and relatively lower interest-bearing deposit balances.

Because of higher litigation and restructuring charges, the company’s expenses have remained elevated over the past few years. Moreover, the company projects an increase in technology-related for 2019, reflecting the ramp-up of spend in 2018.

Nevertheless, overall costs are expected to have remained manageable in the fourth quarter, given the elimination of unnecessary management layers.

What the Zacks Model Unveils

According to our quantitative model, chances of BNY Mellon beating the Zacks Consensus Estimate in the fourth quarter are high. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or better — which is required to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for BNY Mellon is +0.36%.

Zacks Rank: The company currently carries a Zacks Rank #2 (Buy).

Other Stocks That Warrant a Look

Here are some other finance stocks that you may want to consider as these too have the right combination of elements to post an earnings beat in their upcoming releases, per our model.

TD Ameritrade Holding Corporation AMTD has an Earnings ESP of +1.85% and a Zacks Rank #3 at present. The company is slated to release results on Jan 21.

Associated Banc-Corp ASB is slated to release results on Jan 23. It presently has an Earnings ESP of +1.10% and a Zacks Rank #3.

Federated Investors, Inc FII is slated to release results on Jan 30. It currently has an Earnings ESP of +2.13% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

Associated Banc-Corp (ASB) : Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD) : Free Stock Analysis Report

Federated Investors, Inc. (FII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance