Groupon (GRPN) Q4 Loss Wider Than Expected, Revenues Down Y/Y

Groupon GRPN reported fourth-quarter 2022 non-GAAP loss of 38 cents per share, wider than the Zacks Consensus Estimate of a loss of 23 cents. The company reported non-GAAP earnings of 18 cents per share in the year-ago quarter.

Revenues of $148.2 million missed the Zacks Consensus Estimate by 8.58%. The figure declined 33.6% on a year-over-year basis (down 30% excluding the foreign exchange effect).

Region-wise, North America revenues slumped 32% year over year to $106.1 million. International revenues fell 38% (down 30% excluding the foreign exchange effect) to $42.1 million.

Quarterly Details

Local revenues of $127.9 million declined 30% year over year (down 28% excluding the foreign exchange effect). North America Local revenues decreased 31% while International Local revenues fell 29% year over year.

Consolidated Travel revenues decreased 42.4% year over year to $5.9 million. North America Travel revenues declined 35.1% year over year. International Travel revenues decreased 50.7% in the reported quarter.

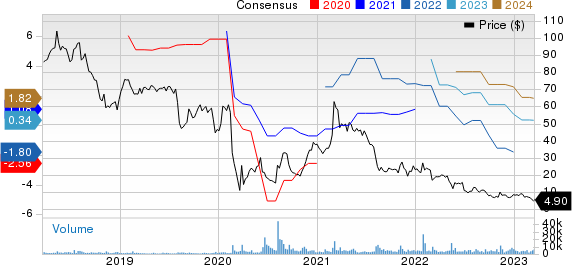

Groupon, Inc. Price and Consensus

Groupon, Inc. price-consensus-chart | Groupon, Inc. Quote

On a consolidated basis, Goods revenues declined 50.6% year over year to $15.1 million. North America Goods revenues declined 41.9% while International Goods revenues fell 53.5%, excluding the foreign exchange effect, on a year-over-year basis.

Customer Metrics

At the end of the fourth quarter, Groupon had approximately 18.8 million active customers compared with 23.3 million at the end of the previous quarter.

At the end of the fourth quarter, the company had approximately 8.07 million active customers based in North America and 5.03 million active international customers.

Operating Details

In the fourth quarter, gross profit came in at $129.1 million, down 33.7% year over year.

Selling, general and administrative expenses fell 11.6% year over year to $111.8 million in the reported quarter. Marketing expenses decreased 19.7% to $23.1 million.

The company reported operating earnings of $6 million against a loss of $2.5 million in the year-ago quarter.

Balance Sheet & Cash Flow

Groupon exited the quarter with cash and cash equivalents of $281.3 million, down from $308 million as of Sep 30, 2022.

In the fourth quarter, the company generated $15.9 million in operating cash flow against the operating cash flow of $43.5 million generated in the prior quarter.

Groupon reported a free cash flow of $10.2 million against $51.8 million of free cash outflow reported in the previous quarter.

Guidance

For the first quarter of 2023, Groupon expects an adjusted EBITDA loss of $5-$10 million. It anticipates significant cash outflow in the current quarter.

Zacks Rank & Stocks to Consider

Groupon currently has a Zacks Rank #3 (Hold).

Groupon shares were down 6.33% in pre-market trading following the results. This Zacks Rank #3 (Hold) company’s shares have underperformed the Zacks Retail Wholesale sector, as well as its Zacks Internet Commerce peers like MercadoLibre MELI, PDD Holdings PDD and Booking Holdings BKNG in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Groupon shares have declined 73.9% in the past year while the Retail Wholesale sector has been down 17.8%. PDD, MercadoLibre and Booking Holdings shares have gained 140%, 5.7% and 12.9% in the past year, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Groupon, Inc. (GRPN) : Free Stock Analysis Report

MercadoLibre, Inc. (MELI) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

PDD Holdings Inc. (PDD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance