Greenback Gains Ground Against Loonie Ahead of US Retail Sales Data

The US dollar is up today. The buck is currently making its biggest gains versus the Japanese yen and the Canadian dollar. Yesterday, the US dollar was weak during European trading hours thanks to a rebound in the euro. Later in the day, the dollar made gains following speeches from St. Louis Fed’s Bullard and US Secretary of Commerce Wilbur Ross. As US growth and inflation remains high, economic conditions remain supportive for the dollar. This is especially the case as the outlook for US growth is better than all other major regions. After declining last week, US Treasury bond yields rose yesterday. 10-year Treasuries closed above 3% last night and is currently yielding 3.019%. Thanks to significant gains in crude oil prices this year, inflation and interest rates are likely to keep accelerating.

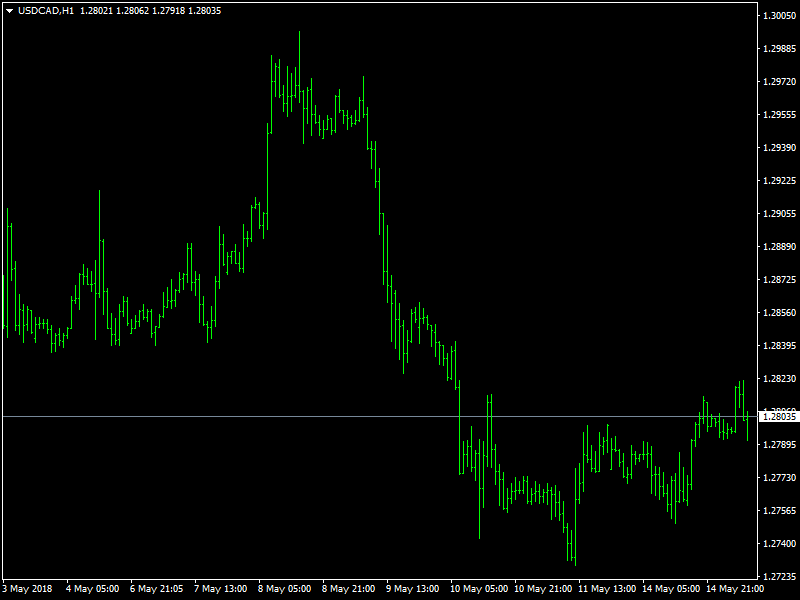

USDCAD Awaits Data

Speaking in France, Cleveland Fed President Mester said the Federal Reserve should continue its gradual approach to raising interest rates given that inflation has not yet reached the U.S. central bank’s 2 percent goal in a sustained way. This supports public opinion of further rate hikes by US Fed later this year. Moving forward Analysts believe US economic data is likely to slow over the coming weeks as they predict rate of growth probably peaked in Q1 2018. However short term outlook continues to remain in USD bull’s favor.

Economic Calendar continues to remain light in Canada with no major releases yesterday or today. In Canadian market investors await manufacturing sales data to be released on Wednesday along with a speech from Lawrence Schembri – Deputy Governor of the Bank of Canada. USD is likely to gain strength as trading session progresses today and tomorrow with multiple major impact news scheduled across European and American session in next 48 hours. Traders need to exercise a bit of caution and watch the price action clodely before entering. Expected support and resistance are at 1.2769 / 1.2739 and 1.2833 / 1.2886 respectively.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance