Corn, Soybeans and Other Softs Review Yield Revisions and Angry Farmers

Corn, Soybeans and other softs futures are in review following Pro Farmer Midwest Crop Tour numbers and divergencies with the WASDE report.

Also, the USDA is complaining about threats against their officials from angry farmers.

Pro Farmer Crop Tour’s different numbers and the Angry Farmers

The widely watched crop tour is pointing to a lower reading for Illinois crop yields in contrast to the WASDE figures reported two weeks ago. Illinois is a big concern for farmers and grain investors are it is the second-largest corn-growing state in the US.

In this framework, US farmers are complaining that the government crop report did not reflect damage from extreme weather conditions in the last months; and it looks like they are right after the Pro Farmer Crop Tour is reporting significantly lower yields than the WASDE report.

Farmers are also frustrated because of the damage the trade war is inflicting to businesses and the incapability to sell crops.

In that situation, angry farmers are starting to complain in a more vigorous way against government officials as Hubert Hamer, administrator of the statistics service, said in a statement.

“A USDA National Agricultural Statistics Service employee received a threat while on the Pro Farmer Crop Tour from someone not involved with the tour.” So, they pulled all their staff out of the pro tour.

Soybeans at highs of the day

Soybeans are trading higher for the third day as investors are digesting Pro Farmer Midwest Crop tour reports on more downward revisions on yield prospects. The unit is on its way to test the 8.83 area, where August highs are.

The oilseed is currently moving higher after the unit broke the 8.76 area and it is now intra-day highs at 8.82. The contract is 0.74% positive on the day.

The 1-hour chart shows some bullish interest, but the unit will need a break above highs of 8.83 as mentioned before. Above that level, future contracts for soybean will see 8.92 as the next resistance. Above, the psychological $9.00 per bushel will be waiting.

To the downside, 8.76 is the support in the short term. Below, the 8.73-8.72 area is a congested zone where bulls and bears are fighting. Then, pay attention to the 8.72 support.

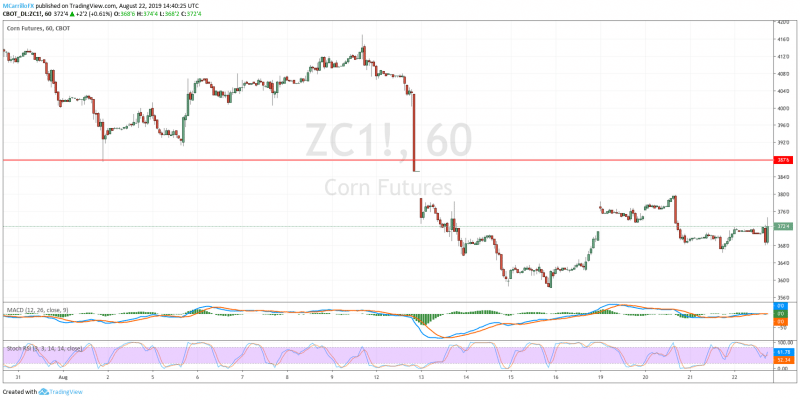

Corn recovers from intra-day lows

Futures of corn are trading in recovery mode after a brief drop that sent the unit to trade at lows of the day at 3.68. Then, the contract bounced at that price and reached the high of the day at 3.74.

Previously on the day, the unit was trading virtually flat around 3.71 as investors were digesting Pro Farmer Midwest Crop tour yield revisions to the downside and news of angry farmers complaining against Trump agenda on trade war and farm products.

Currently, corn contracts are trading at 3.71 again, 0.27% positive on the day. Technical studies signal more sideways in the hourly chart, but if we open the microscope a bit, the unit remains bearish with the 3.80 acting as a container for any upside attempt.

Supports are now at the mentioned $3.68 per bushel, then the intra-week low at 3.66 and the 3.64 critical level.

To the upside, 3.72 is again a resistance, above there, the mentioned 3.80, August 20 high, and finally the 3.87 critical level.

Wheat failed at 4.73, back to previous levels

Futures of Wheat are trading positive for the second day on Thursday as investors are digesting crop yields and angry farmer reports. Recently, the unit bounced back from intra-day lows at 4.66 to break above the 4.69 resistance, and it pushed forward to $4.73 per bushel.

However, the unit was unable to sustain gains, and it is now trading back to 4.69, where it is trading now, still 0.32% positive on the day.

The 4.75 level contains the unit, and the 4.62 area supports it. Technical conditions suggest a more positive approach coming, but the strength is not enough.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance