Here's what Goldman Sachs told its millionaire clients about 2017

“We may have a bumpy ride, but the US economy will not be derailed.”

That’s the message Goldman Sachs Private Wealth Management has just telegraphed to its high-net-worth, multimillionaire clients.

In a somewhat gloomy 90-page note, Goldman Sachs’ Sharmin Mossavar-Rahmani and Brett Nelson warn that the bull market is getting stretched and that valuations look rich.

“Since the trough of the global financial crisis, we have consistently emphasized US preeminence and maintained a strategic overweight to US equities relative to global market capitalization-weighted benchmarks,” they said. “Tactically, we have had an overweight allocation to US equities and US high yield bonds from as early as mid-2008. Even when US equities became more expensive, we continued to recommend that clients stay fully invested at their strategic allocations.”

Nevertheless, they recommend that investors stay fully invested in US equities.

“[N]ow we have crossed into the 10th decile of valuations: US equities have been more expensive than current levels only 10% of the time in the post-WWII period,” they noted. “Yet we continue to recommend staying the course. We are duly aware that this recommendation is long in the tooth, particularly given such high valuations and the unusually high level of policy uncertainty.”

Here’s their rationale verbatim:

Our eight-year US preeminence theme is intact and continues into its ninth year. As Professor Jeremy Siegel of the University of Pennsylvania wrote 23 years ago in Stocks for the Long Run and recently repeated in a Wall Street Journal interview, “Stocks are the best long-run asset.” We refine that view by saying US equities are the best long-run asset.

We think that the policy backdrop in the US will be particularly favorable for the economy, with looser fiscal policy, relatively easy monetary policy and a less stringent regulatory environment. We expect US growth to continue through 2017.

We expect global growth to improve modestly, from 2.5% in 2016 to 2.9% in 2017, with looser fiscal policy and still easy monetary policy in key countries.

And last but not least, we expect that while President-elect Trump’s initial policy measures with respect to tariffs and trade agreements risk jolting financial markets, as a self-described “deal maker” he will likely adjust and change course as necessary to achieve his desired results.

In brief, they are affirming the historical and Trumponomic bullish forces we’ve been hearing across Wall Street.

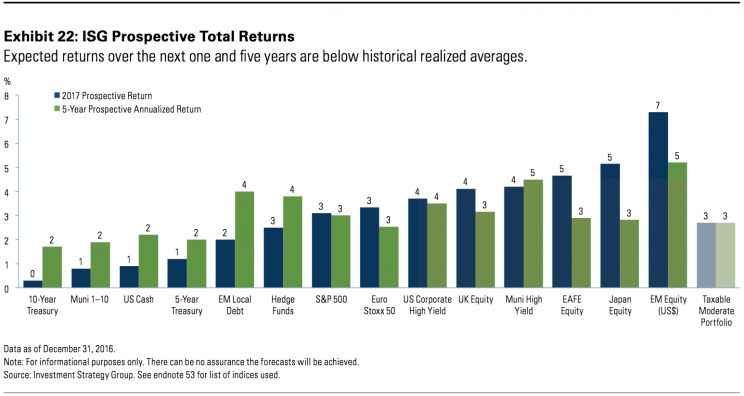

Below’s a look at their outlook for various asset classes. As you can see, the numbers are pretty lackluster.

Geopolitical risks and Trump

Mossavar-Rahmani and Nelson spend quite a bit of time laying out the many outstanding political risks facing the world.

“Policy uncertainty, both economic and political, abounds globally: uncertainty with respect to Brexit (the how and when), upcoming elections in Germany and France (the who), transitional government in Italy (the how long followed by what) and new appointments to the Standing Committee in China and their significance (the who and what of any reform agenda), to name a few,” they said.

And then, of course, there’s the elephant in the room.

“In Donald Trump, the US has elected an unconventional president in many respects, including his more US-centric approach to China. If China responds to, say, imposition of US tariffs on imports of Chinese products by sharply devaluing the renminbi, significant downside volatility and tighter global financial conditions will follow,” they noted.

The note is an interesting and meaty read for the average investor. Read it at GoldmanSachs.com.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Investors enter 2017 in front of a stock market ‘steam roller’

Depressing 1930s chart shows what happened last time we had Trump-like trade policy

Yahoo Finance

Yahoo Finance