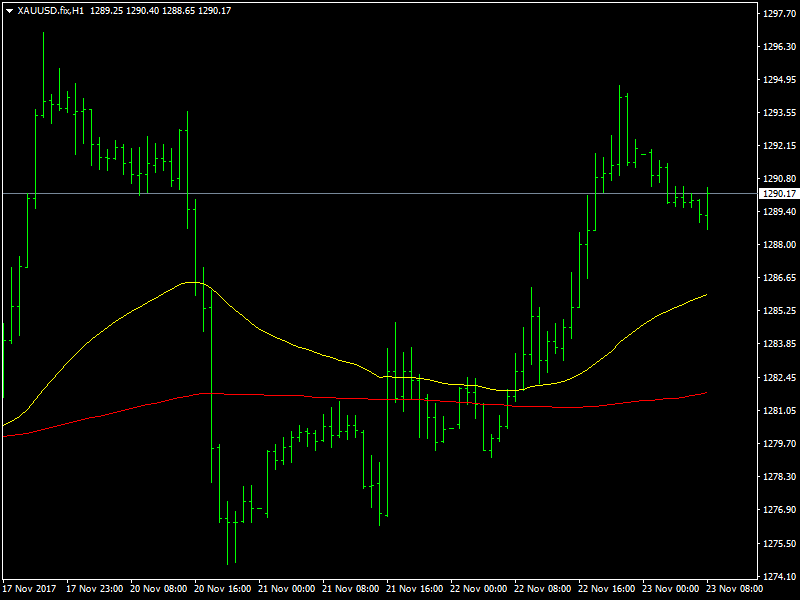

Gold Prices Higher on Dollar Weakness

Gold prices rose higher on the back of a weak dollar but still they are finding the 1300 region to be a hard one to crack through. We have been saying that the gold prices have been in a consolidation and ranging mode for the past couple of months with little chances of a break through and the same seems to be continuing as of this week as well. The fact that the gold prices have been unable to break through the $1300 region despite the weakness of the dollar shows that the demand for the metal is probably very low and this is likely to continue to be the situation in the near future as well.

Gold Still Under 1300

Yesterday, the dollar was on the backfoot right from the beginning of the day and this only became worser as the day progressed reaching its full limits as the FOMC minutes came out. These minutes were more dovish than what the market was expecting it to be and this led to a sell off in the dollar. The minutes just confirmed the rate hike in December but with most of the news almost already fully priced into the markets, the market chose to focus on the dovishness in the minutes as far as the future rate hikes were concerned. The Fed members were not very convinced about the future rate hikes as yet and as usual, the Fed said that they would be watching the incoming data to determine whether or not to hike rates in 2018. This was not liked by the markets and the following dollar sell off pushed the gold prices towards the 1295 region from where it has corrected a bit as of this morning.

Oil prices continued to move steadily higher during the course of the day yesterday and this is just a continuation of the price action in the oil prices that we have been seeing over the last few months. This is expected to continue in the short term as we dont see any major issues looming ahead of the oil market in the short term as yet.

Silver prices were choppy at best as they failed to follow the gold prices higher despite the weakness in the dollar over the last 24 hours. This choppiness along with ranging is likely to continue in the short term.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance