Gold Price Futures (GC) Technical Analysis – October 19, 2017 Forecast

December Comex Gold futures are recovering from early session weakness on geopolitical concerns. However, gains are being limited by rising U.S. Treasury yields and a firmer U.S. Dollar.

Today’s rally is being fueled by events in Europe. According to CNBC, “The Catalonia crisis is expected to reach new heights on Thursday with Spain looking likely to use its so-called “nuclear option” against the region, unless there is a last-minute change of heart from the pro-separatist leadership.”

Catalonia’s leader Carlos Puigdemont has until 10 a.m. local time Thursday morning (0900 GMT) to withdraw the declaration of independence he made last week or force Prime Minister Mariano Rajoy to invoke Article 155 of the Spanish Constitution – its “nuclear option” which would allow Madrid to take control of the region, following approval from the Spanish Senate.

The early price action suggests the crisis in Spain will override concerns over rising U.S. Treasury yields today.

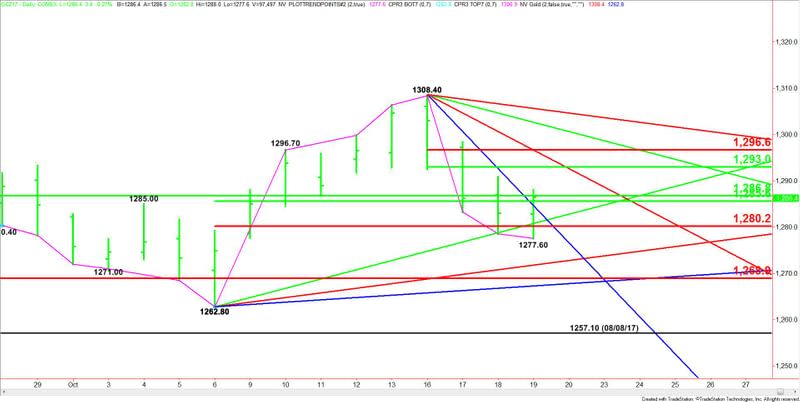

Daily Technical Analysis

The main trend is down according to the daily swing chart. Momentum is neutral. Last week, momentum was trending higher. This week, it’s trending lower.

The main range is $1262.80 to $1308.40. Its retracement zone at $1285.60 to $1280.20 is currently being straddled. This zone falls inside a major retracement zone bounded by $1286.80 to $1268.90. Trader reaction to the main retracement zone is likely to set the tone for the day.

The new short-term range is $1308.40 to $1277.60. If the rally extends today then its retracement zone at $1293.00 to $1296.60 will become the primary upside target.

Daily Forecast

Based on the current price at $1285.10 and the earlier price action, the direction of the gold market today is likely to be determined by trader reaction to the major 50% level at $1286.80.

A sustained move over $1286.80 will signal the presence of buyers. This could spike the market into a short-term 50% level at $1293.00, or a resistance cluster at $1296.40 to $1296.60.

A sustained move under $1286.80 will indicate the presence of sellers. However, this could trigger a labored break with potential targets at $1285.60, $1284.40, $1280.80 and $1280.20.

The daily chart starts to open up to the downside under $1280.20 with today’s intraday low at $1277.60 the next target. This is followed by an uptrending angle at $1271.80.

Watch the price action and read the order flow at $1286.80 all session. Trader reaction to this level will tell us if the bulls or the bears are in control.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini S&P 500 Index (ES) Futures Technical Analysis – October 19, 2017 Forecast

Nikkei and Dow Jones Industrials at Record Highs, US Futures Lower, Gold Rises

Federal Reserve Leadership Becoming a Focus, Asian Stocks Mixed after China Growth Data

Gold Price Futures (GC) Technical Analysis – October 19, 2017 Forecast

E-mini Dow Jones Industrial Average (YM) Futures Analysis – October 19, 2017 Forecast

Yahoo Finance

Yahoo Finance