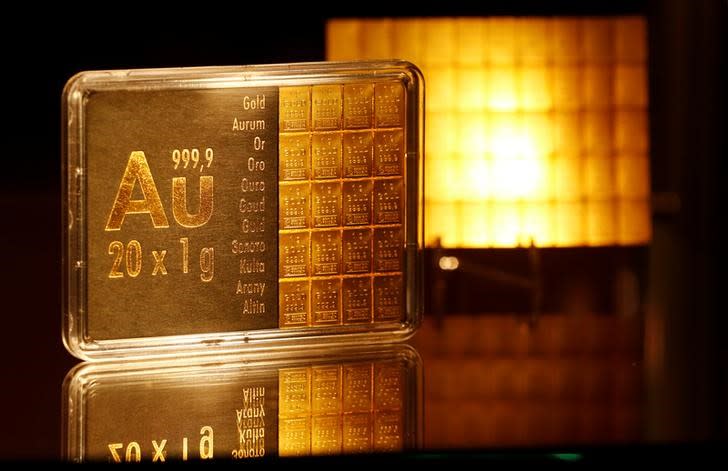

Gold at six-week low as focus shifts to U.S. payrolls data

By Marcy Nicholson and Jan Harvey

NEW YORK/LONDON (Reuters) - Gold fell to a six-week low on Tuesday after Federal Reserve officials sounded a hawkish note on interest rates, boosting the dollar, while attention turned to U.S. payrolls data this week for further clues on the pace of rate hikes.

Fed Chair Janet Yellen said on Friday the case for higher rates was strengthening, though she gave little clarity on the timing of a move. In an interview on Tuesday, Vice Chair Stanley Fischer said the U.S. job market is nearly at full strength and that the pace of rate increases by the Fed will depend on how well the economy is doing.

U.S. consumer confidence rose to an 11-month high in August, pressuring U.S. stocks lower due to concerns about a rate hike this year, while the dollar rose 0.5 percent. [MKTS/GLOB]

Spot gold was down 0.8 percent at $1,312.71 an ounce by 2:49 p.m. EDT (1849 GMT), after falling as low as $1,311.65, the lowest since July 21.

U.S. gold futures for December delivery settled down 0.8 percent at $1,316.5 per ounce.

Non-farm payrolls due on Friday are seen as a key measure of the strength of the U.S. labor market. Employers are expected to show 180,000 job gains in August, according to a Reuters poll, below the better-than-expected 255,000 additions in July.

"It looks as though we're going to see another pretty solid month of jobs gains, and that should mean that there's a return (of expectations for) a September rise - there's still an outside chance of that, according to fed funds futures - or more realistically, a December rate rise," Mitsubishi analyst Jonathan Butler said.

"That is probably going to weigh on gold."

Gold is highly sensitive to rising U.S. interest rates, as these increase the opportunity cost of holding non-yielding bullion, while boosting the dollar, in which it is priced.

"We reiterate our view that gold prices will weaken, resulting in an annual average price of $1,258/oz in 2016, and $1,241/oz in 2017," said Christopher Louney, commodity strategist for RBC Capital Markets.

"Upcoming Fed announcements will be key to whether or not our investment thesis stands, but given the investor-only nature of this year’s gold rally, we still think it is tenuous at best, or primed for a correction at worst."

Silver was down 1.3 percent at $18.59 an ounce, having hit a two-month low of $18.36 in the previous session.

Platinum was down 2.1 percent at $1,050.99, the lowest since July 5, while palladium was down 3.2 percent at $673.72, the lowest since July 25.

(Additional reporting by Nallur Sethuraman in Bengaluru; editing by Louise Heavens and Tom Brown)

Yahoo Finance

Yahoo Finance