Gold, GBP and Inflation Expectations Grabbing My Attention

I touched on this in the chart of the day, but with the world’s central banks watching inflation and inflation expectations incredibly closely, it makes sense macro traders do too.

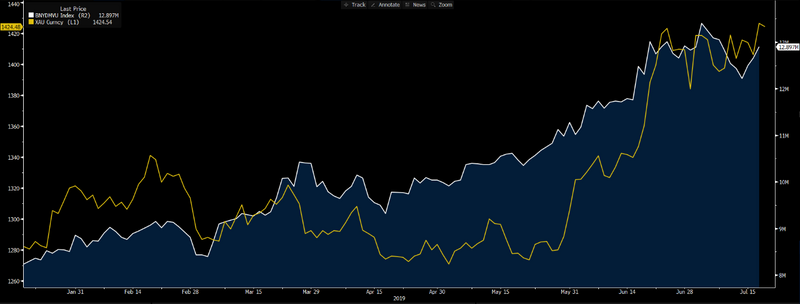

That is what we saw in US trade, and the wash-up has been a renewed bid in the bond markets, taking the pool of negative-yielding government bonds $239m higher on the day, to currently sit at $12.8t. I’ve looked at this in relation to gold below, and while a two-year regression shows the correlation between the two variables is not overly significant, it’s fair to say there is a shared theme here.

Rates pricing moving towards 50bp of cuts

We can also look at the US rates market overnight, where we can now see a 34% chance of a 50bp cut, and while I should probably apologies for persistently banging this US-centric drum, there is no doubt the 25bp-50bp debate is the big talking point out there right now. If we see US 5-year inflation expectations heading back towards 1.90%, then it markedly increases the possibility of a 50bp cut, despite certain better US data points, and if this materialises, watch the markets fire up.

In fact, we may get a touch more clarity tonight, where at 04:15aest NY Fed President John Williams speaks on monetary policy. Williams is a core voting member within the Fed, so any hints that he is genuinely worried about the external picture and vulnerabilities in the global economy and we may see the interest rate markets move to price a 50% chance of a 50bp. This is an event risk for traders.

With the global growth story in mind, it segways nicely into today’s Bank of Korea meeting, where we saw an out-of-consensus rate cut to 1.5%. Some will point to tensions with Japan behind the easing, but some see the weakness in Korean exports as a leading guide on the external demand thematic, and we can see how this correlates with the MSCI All country index.

Gold to $1500?

Going back to the Williams speech, should we get clues he’s steering to 50bp, which seems unlikely, but should it play out, then in this scenario, gold (XAUUSD) builds on the move we saw yesterday, and we head onwards and upwards towards $1500.

Aussie factors weighing on XAUAUD

In fact, if we look at gold in EUR terms (XAUEUR), we can see the price here has broken to new highs, with an outside period seen in yesterday’s candle. AUD-denominated gold (XAUAUD) has yet to kick higher and hasn’t benefited from the modest AUD strength seen in the wake of the Aussie job’s numbers. Which, when digging into the numbers are a small positive given we saw strong full-time jobs creation and the participation rate was slightly better. The NAB business confidence report also improved.

We always follow price as a voting mechanism to understand why people are buying and why they are selling where they are. But there is a raft of different ways we can assess sentiment towards any market and many in the institutional space like to look at the options world as a guide. I am happy to provide clients information on options skews if it helps, but if I look at the difference (or the ‘skew’) of call vs put implied volatility, we see this sits at an all-time high of 4.

The higher the demand for call options, which give us the right to buy, the higher the implied volatility. So, when the skew is so heavily favoured towards structures that give us the right to buy should the market price be above the strike price, you can see exactly where options traders feel the balance of risk lies for the yellow metal.

Pairs trading – if you’re not doing it and interested let me know

While the bulk of our flow has been in gold and GBP, we are seeing good interest in US equity indices, and the flow is two-way. There is a battle underway in the S&P 500, and the earnings rolling in are not helping to any great degree.

One way of trading an index is through ‘pairs’ trading. Take a look at the S&P 500 (US500)/Russell 2000 (US2000) ratio. Ratio analysis is just one way to look at this, but it gives a guide on how the markets are interacting with each other and the outperformance. In this case, the US500 is the numerator, so when this index is going up, we see the US500 outperforming the US2000.

Being long the US500 and short the US2000 has been working so well that the ratio sits at the highest levels since 2009. If this breaks out convincingly, I will be looking at exposures here.

The math is simple

When looking at pair’s trades, it is key that both legs of the trade have the same notional exposures, or at least as close as possible. So, we, therefore, start with a USD amount, let’s say $10,000 and then divide this by the index level at the time. So, with the US500 trading at 2984 and US2000 at 1550, I would buy 3.4 contracts of US500 ($10,000/2984) and sell 6.5 contracts of US5000. Or, vice versa if you feel the US2000 will outperform,

Trading pairs (or long/short) strategies are lower beta, meaning they don’t tend to have sizeable P&L swings and can be a great way to really hone in on one theme and exploit it.

Anyhow, I find it an interesting way to trade markets and happy to offer more guidance if clients are interested.

Sign up here for my Daily Fix or Start trading now

Chris Weston, Head of Research at Pepperstone.

(Read Our Pepperstone Review)

This article was originally posted on FX Empire

More From FXEMPIRE:

U.S. Dollar Index Futures (DX) Technical Analysis – Pivot at 96.760 Controls Direction into Close

Gold Weekly Price Forecast – Gold markets continue to test resistance

USD/JPY Weekly Price Forecast – US dollar chops around against Japanese yen for the week

Natural Gas Weekly Price Forecast – Natural gas markets break down for the week

Yahoo Finance

Yahoo Finance