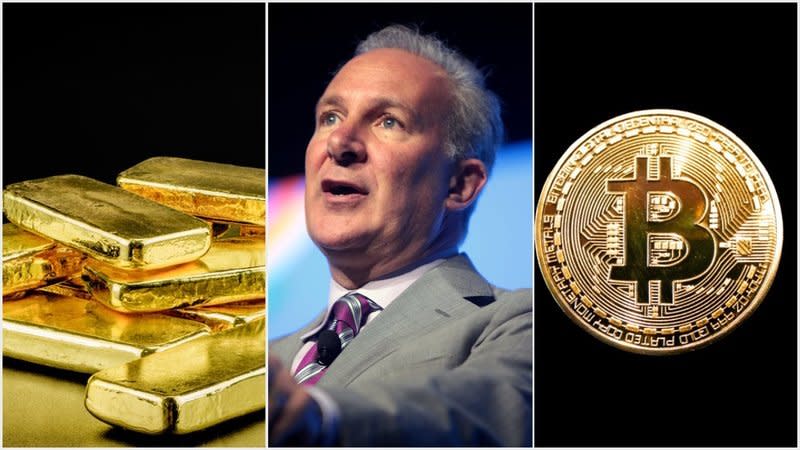

Gold Bug Peter Schiff Celebrates Metal’s Pitiful Gains, Bashes Bitcoin

By CCN Markets: Longtime crypto critic and gold proponent Peter Schiff is excited. He’s not happy due to the stock market hitting new all-time highs or bitcoin prices surging but rather by a microscopic advance in the price of gold.

This week, the price of gold topped $1,400 per ounce for the first time in more than five years. This, a mere 25% rally from recent lows, was enough for Schiff to declare victory:

Schiff dismisses bitcoin’s huge gains while declaring a new gold bull market | Source: Twitter

Over the last year exactly, it is up $130 per ounce or 10 percent.

Schiff: Wrong on Gold for a Long Time

Peter Schiff has reasons to stay permanently bullish on gold. For one, he runs a website which buys and sells physical gold and silver. His asset management company also runs a mutual fund that invests in gold-related stocks. Over the past five years, it has returned less than 1 percent annually. Forget topping bitcoin, Schiff’s gold fund hasn’t even been able to keep up with a savings account.

Yahoo Finance

Yahoo Finance