Globus Medical (GMED) Q1 Earnings Beat, Operating Margin Dips

Globus Medical, Inc. GMED reported adjusted earnings per share (EPS) of 53 cents for the first quarter of 2023, beating the Zacks Consensus Estimate by 3.9%. The metric also surpassed the year-ago adjusted EPS by 26.2%.

The adjusted EPS excludes certain non-recurring expenses like the amortization of intangibles and acquisition-related costs/licensing.

Without adjustments, the company registered a GAAP EPS of 48 cents, a 29.7% increase from the year-ago figure.

Revenues

Worldwide sales in the quarter under review totaled $276.7 million, up 20% year over year (increased 21% at Constant Exchange Rate). The reported figure exceeded the Zacks Consensus Estimate by 8.9%.

Quarterly Details

During the quarter under review, sales generated in the United States, increased 19.2% year over year to $234.1 million. Internationally, revenues increased 24.7% to $42.6 million, up 31.5% year over year at CER.

Through its product category, Musculoskeletal Solutions generated revenues of $251.6 million, up 15.7% year over year. Growth was led primarily by the company’s spine business, driven by strong procedural volumes both in the United States and internationally, driven by continued share uptake as well as favorable comps year over year.

Enabling Technologies' product revenues of $25.1 million in the quarter improved 90.8% from the prior-year figure. The significant year-over-year surge was driven by ongoing demand for the company’s robotics and imaging system technologies.

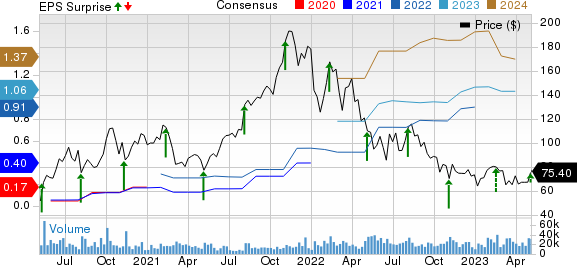

Globus Medical, Inc. Price, Consensus and EPS Surprise

Globus Medical, Inc. price-consensus-eps-surprise-chart | Globus Medical, Inc. Quote

Margin

The gross profit in the reported quarter rose 20.1% year over year to $205.8 million. The gross margin expanded 7 basis points (bps) to 74.4%.

SG&A expenses in the reported quarter were $122.4 million, up 21.5% from the year-ago quarter. The increase reflected higher personnel-related expenses, primarily driven by sales compensation, as well as higher meetings, travel and training expenses. Research and development expenses decreased 21.1% to $21.1 million.

The quarter’s adjusted operating profit rose massively to $62.4 million, up 17.2% from the year-ago quarter. However, the adjusted operating margin contracted 55 bps in the quarter to 22.5%.

Cash Position

Globus Medical exited the first quarter of 2023 with cash and cash equivalents, and short-term marketable securities of $504.4 million compared with $446.1 million at the end of 2022.

Cumulative net cash provided by operating activities at the end of the first quarter was $53.3 million compared with the year-ago figure of $44.7 million.

On Feb 9, 2023, the company announced its plans to acquire the San-Diego based spine technology firm, NuVasive Inc., in an all-stock deal valued at around $3.1 billion. The transaction, which is expected to close in mid-2023, reflects both companies’ vision to improve patient care through innovation in unmet clinical needs.

2023 Guidance

The company has reaffirmed its 2023 guidance.

With the planned purchase in the picture, full-year net sales are projected to be $1.1 billion, indicating 7.5% growth compared with the previous year. The Zacks Consensus Estimate for the same is also currently pegged at $1.1 billion.

The company’s adjusted EPS guidance for 2023 is pegged at $2.30, suggesting 11.7% growth from 2022. The Zacks Consensus Estimate for the same is pegged at $2.30 currently.

Our Take

Globus Medical exited the first quarter of 2023 with earnings and revenue beat. The robust growth of organic revenues in both the United States and the international market is impressive. Rapid market interest and customer demand have positioned Excelsius3D, the company’s latest addition to the Excelsius Ecosystem, as a major growth driver in 2023.

According to GMED, this above-market growth is driven by competitive rep recruiting from prior quarters, robotic pull-through and the normalization of post-COVID procedures on a year-over- year basis. In the first quarter, the company launched the MARS TLIF pedicle-based retractor as part of its focus on procedural efficiency to offer specialized options to meet surgeon preferences.

Zacks Rank and Key Picks

Globus Medical currently has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Edwards Lifesciences Corporation EW, Intuitive Surgical, Inc. ISRG and Johnson & Johnson JNJ.

Edwards Lifesciences, carrying a Zacks Rank #2 (Buy), reported first-quarter 2023 adjusted EPS of 62 cents, beating the Zacks Consensus Estimate by 1.6%. Revenues of $1.46 billion outpaced the consensus mark by 4.7%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Edwards Lifesciences has a long-term estimated growth rate of 6.8%. EW’s earnings surpassed estimates in two of the trailing four quarters, missed the same in one and came in line in the other, the average being 1.2%.

Intuitive Surgical, having a Zacks Rank #2, reported first-quarter 2023 adjusted EPS of $1.23, which beat the Zacks Consensus Estimate by 3.4%. Revenues of $1.70 billion outpaced the consensus mark by 6.9%.

Intuitive Surgical has a long-term estimated growth rate of 13%. ISRG’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average being 1.9%.

Johnson & Johnson reported first-quarter 2023 adjusted earnings of $2.68 per share, beating the Zacks Consensus Estimate by 6.8%. Revenues of $24.75 billion surpassed the Zacks Consensus Estimate by 5%. It currently carries a Zacks Rank #2.

Johnson & Johnson has a long-term estimated growth rate of 5.5%. JNJ’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance