Globus Medical (GMED) to Gain From NUVA Deal Amid Rising Costs

Globus Medical GMED continues to witness surging demand for its Musculoskeletal Solutions products. Meanwhile, the NuVasive (NUVA) deal is an added positive. Yet, we are worried about the challenging pricing scenario that continues to plague Globus Medical.

GMED carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Globus Medical exited the fourth quarter of 2022 with an earnings beat. The robust growth of organic revenues in both the United States and the international market is impressive. Rapid market interest and customer demand have positioned Excelsius3D, the company’s latest addition to the Excelsius Ecosystem, as a major growth driver in 2023. The company delivered its 12th consecutive quarter of sequential growth in the Trauma business with 70% growth in the reported quarter. Internationally (excluding Japan), Globus’ spinal implant business also delivered double-digit growth in most markets.

Higher net sales and the acquisition of in-process research and development contributed to the quarter’s GAAP net income, which increased by 231.4% from the prior year’s quarter figure.

The company launched seven new products in 2022, four of which debuted in the fourth quarter, when the company launched its prone-lateral patient positioning system as part of its focus on the continuum of care. Further, it also launched the AUTOBAHN EVO Femoral Nail systems in Q4.

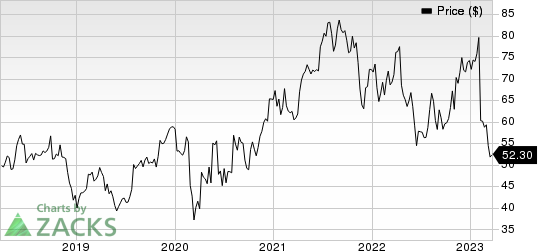

Globus Medical, Inc. Price

Globus Medical, Inc. price | Globus Medical, Inc. Quote

In terms of the NuVasive acquisition deal with the complementary strengths of Globus Medical engineering and NuVasive relations, education and training, GMED aims to outpace market growth, leading to accelerated EPS growth and an increase in cash flows for investors. To drive sales growth, the combined company expects to outpace market growth and gain share while maintaining financial discipline. Also, it expects to continue with mid-30s EBITDA, accelerate EPS growth and increase cash flows for the investors.

On the flip side, Globus Medical exited the fourth quarter of 2022 with a revenue miss. Escalating costs are building pressure on the gross margin. The Q4 gross margin contracted 100 basis points (bps) to 74.3% due to a product mix and higher freight costs. The continued impact of non-operating headwinds is a major downside.

Meanwhile, the musculoskeletal devices industry is characterized by intensifying competitive pricing pressure. Pricing continues to remain a major headwind for Globus Medical. We remain concerned about the pricing scenario, as it will be affected by cost containment efforts by governmental healthcare, local hospitals and health systems.

Further, the musculoskeletal devices industry faces intense competition as well as the challenges of third-party coverage and reimbursement practices. Management believes that there will be continued pricing pressure in the future. If competitive forces drive down the prices the company charges for its products, its profit margins will shrink, thus adversely affecting Globus Medical’s ability to maintain its profitability and to invest in and grow its business.

Over the past year, shares of Globus Medical have underperformed its industry. The stock declined 23.1% compared with the 14.4% fall of the industry.

Key Picks

Some better-ranked stocks in the overall healthcare sector are Haemonetics Corporation HAE, Catalyst Pharmaceuticals CPRX and Avanos Medical AVNS. Haemonetics and Catalyst Pharmaceuticals each sport a Zacks Rank #1, while Avanos Medical has a Zacks Rank #2 (Buy).

Haemonetics’ stock has risen 28.0% in the past year. Earnings estimates for Haemonetics have remained constant at $2.94 in 2023 and $3.29 in 2024 in the past 30 days.

HAE’s earnings beat estimates in all the last four quarters, delivering an average surprise of 10.98%. In the last reported quarter, it reported an earnings surprise of 7.59%.

Estimates for Catalyst Pharmaceuticals’ 2023 earnings have increased from $1.17 to $1.42 in the past 30 days. Shares of the company have increased 100.5% in the past year.

CPRX’s earnings beat estimates in three quarters while beating the same in one, the average surprise being 3.35%. In the last reported quarter, Catalyst Pharmaceuticals delivered an earnings surprise of 4.76%.

Estimates for Avanos Medical’s 2023 earnings have increased from $1.64 to $1.68 in the past 30 days. Shares of the company have declined 15.5% in the past year compared with the industry’s fall of 16.3%.

AVNS’ earnings beat estimates in all the trailing four quarters, the average surprise being 11.01%. In the last reported quarter, Avanos Medical delivered an earnings surprise of 25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Catalyst Pharmaceuticals, Inc. (CPRX) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance