Is Gibson Energy (TSE:GEI) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Gibson Energy Inc. (TSE:GEI) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Gibson Energy

What Is Gibson Energy's Net Debt?

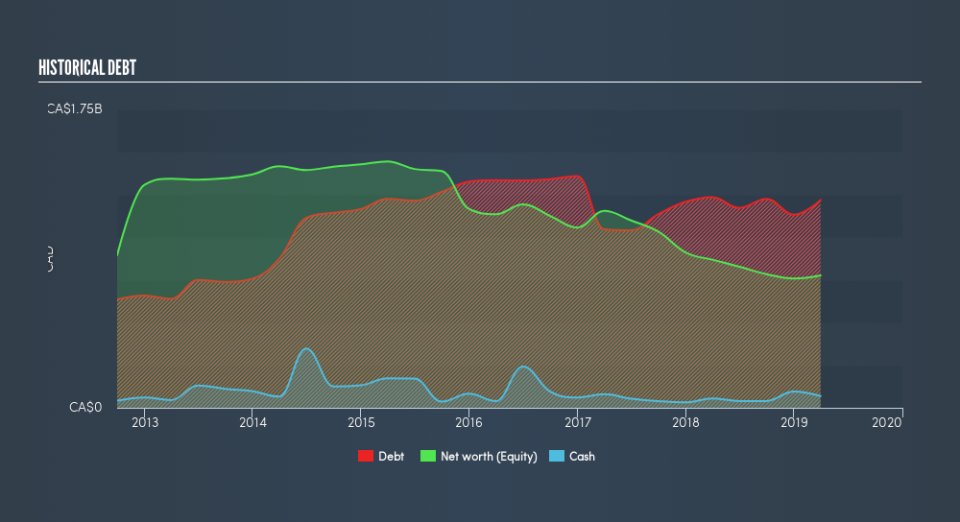

The image below, which you can click on for greater detail, shows that Gibson Energy had debt of CA$1.22b at the end of March 2019, a reduction from CA$1.34b over a year. However, because it has a cash reserve of CA$68.8m, its net debt is less, at about CA$1.15b.

How Strong Is Gibson Energy's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Gibson Energy had liabilities of CA$655.1m due within 12 months and liabilities of CA$1.57b due beyond that. Offsetting these obligations, it had cash of CA$68.8m as well as receivables valued at CA$456.5m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CA$1.70b.

This deficit isn't so bad because Gibson Energy is worth CA$3.44b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Gibson Energy's debt is only 2.6 times its EBITDA, and its EBIT cover its interest expense 4.0 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. The silver lining is that Gibson Energy grew its EBIT by 158% last year, which nourishing like the idealism of youth. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Gibson Energy can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Gibson Energy produced sturdy free cash flow equating to 65% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Gibson Energy's impressive EBIT growth rate implies it has the upper hand on its debt. But truth be told we feel its interest cover does undermine this impression a bit. All these things considered, it appears that Gibson Energy can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Gibson Energy insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance