Geron (GERN) Stock Surges 40% YTD: What's Driving the Rally?

Geron Corporation’s GERN shares have surged 40% so far this year compared with the industry’s growth of 5.2%, riding on the progress of its sole pipeline candidate, imetelstat.

Imetelstat is being evaluated as a treatment for hematologic myeloid malignancies like myelofibrosis (“MF”) in a phase II IMbark study and myelodysplastic syndromes (“MDS”) in a phase III IMerge study.

Notably, both studies are being conducted by Geron, following the termination of the collaboration related to imetelstat development by Johnson & Johnson JNJ last year. The candidate enjoys an Orphan Drug designation for both indications.

Pipeline Progress

Geron is progressing well with the development of imetelstat. In August, the company initiated the phase III IMerge study and dosed the first patient in October. IMerge is a two-part phase II/III study evaluating imetelstat in lower-risk MDS patients. Previously-reported data from the phase II portion of the study showed that patients treated with imetelstat achieved meaningful and durable transfusion independence, as well as potential disease-modifying activity. The positive data along with the dosage and dosing schedule from the phase II portion formed the basis of the phase III study.

Meanwhile, Geron also added new leaders to its development team with vast experience in oncology and drug development to support the progress of imetelstat.

The company plans to conduct the end of phase II meeting related to the IMbark study in the first quarter of 2020. A decision on the late-stage development of imetelstat in MF will be provided after this meeting. In September, the FDA granted Fast Track designation to the candidate as a treatment for primary or relapsed/refractory MF. This is likely to facilitate frequent interactions with the FDA for the company to discuss the drug's development plan.

Although Geron’s operating expenses are set to increase due to the cost of imetelstat’s development following the termination of the collaboration with J&J, it has sufficient funds to start the phase III portion of the IMerge studies.

However, dependence on a single pipeline candidate is a concern. Any hiccups in the development of imetelstat may hurt Geron’s stock significantly. Meanwhile, a regulatory application for Acceleron Pharma XLRN luspatercept is under review with the FDA seeking approval as treatment for MDS. A decision from the FDA is expected in April 2020. A potential approval to luspatercept for treating MDS is likely to hurt prospects for imetelstat. Aprea Therapeutics APRE is also developing a late-stage candidate as treatment for MDS.

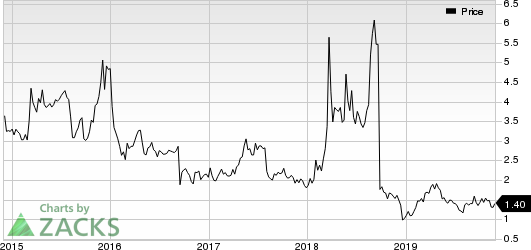

Geron Corporation Price

Geron Corporation price | Geron Corporation Quote

Zacks Rank

Geron currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Acceleron Pharma Inc. (XLRN) : Free Stock Analysis Report

Geron Corporation (GERN) : Free Stock Analysis Report

Aprea Therapeutics, Inc. (APRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance