German Financial Company Says Screw Stocks, Get a Vintage Car Instead

A bank in southern Germany is suggesting that its well-heeled customers consider adding something far more interesting than stocks and bonds to their investment portfolios: classic cars. Jens Berner, a vintage-car expert at Stuttgart’s Südwestbank, told Bloomberg that such investment advice is being given to customers who have more than the equivalent of $1.2 million in liquid assets. It had its origins after the Great Recession, when collectibles such as art, wine, and classic cars emerged as enticing investment alternatives.

Eyeing the opportunity, Südwestbank launched its own Oldtimer Index (OTX) in 2010. It includes the 20 highest-value cars that are at least 30 years old from Stuttgart-area stalwarts such as Mercedes-Benz and Porsche and Bavaria’s BMW and Audi. The index is calculated once a year by multiplying model prices in Germany’s Motor Klassik magazine and marketplace with registration numbers from Germany’s Federal Motor Transport Authority.

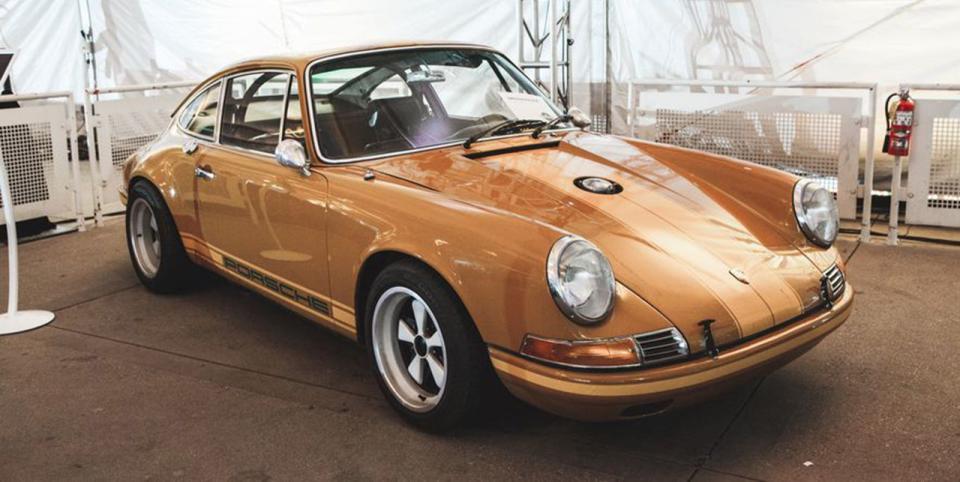

The bank started the index at 100 points and backdated it to 2005. It has tripled in value from then to 2018, outpacing the 204 percent rise in Germany’s benchmark DAX stock index, the bank said, noting that Porsche 911 models have fared especially well, jumping 683 percent during that time.

The OTX index is not immune to volatility, however. According to Südwestbank’s website, it posted a significant decline in 2016 but then began ticking back up slightly in the past year. The BMW Isetta was added back to the index this year, and the Mercedes-Benz 300 Adenauer made its debut, thanks to a higher number of registered vehicles and a price increase. At the same time, the Opel Ascona B and Manta B have been dropped from the OTX because their prices haven’t changed, the bank said. The BMW 2000C and 3.0 CSL have also been left off the index after a fall in prices.

Old Cars, New Respect: Extending Historic Preservation to Automobiles

FCA to Buy, Restore, and Sell Classic Alfa Romeos, Fiats, Lancias, and Abarths

Berner told Bloomberg that while classic cars can be a good investment, potential buyers should be wary of counterfeits, already high prices, and a lack of potential buyers. He suggests investing in vintage cars that have a minimum value of about $117,000 so that the costs of insurance, taxes, storage, and maintenance are a smaller portion of total value and said a classic car should make up no more than 10 to 15 percent of an investment portfolio.

You Might Also Like

Yahoo Finance

Yahoo Finance