General Mills (GIS) Buys TNT Crust, Boosts Accelerate Strategy

General Mills, Inc. GIS has been on track with its Accelerate strategy. In connection with the strategy, the company concluded the previously announced takeover of TNT Crust. As part of this buyout, General Mills also bought two manufacturing facilities in Green Bay, WI and one manufacturing facility in St. Charles, MO.

TNT Crust is a manufacturer of high-quality frozen pizza crusts for regional and national pizza chains, foodservice distributors and retail outlets. Earlier a portfolio company of Peak Rock Capital, TNT Crust’s net sales came in at roughly $100 million in 2021.

The acquisition of TNT Crust helps GIS advance its Accelerate strategy. The acquisition also fortifies the company’s position in the fast-growing away-from-home frozen baked goods category. The rapidly growing TNT Crust business complements General Mills’ frozen baked goods platform by adding scale to the category.

Another action underscoring General Mills’ focus on the Accelerate strategy includes its recently inked deal to offload its Helper main meals and Suddenly Salad side dishes businesses to Eagle Family Foods Group (which is a portfolio firm of Kelso & Company). This highlights the company’s focus on reshaping the portfolio and concentrating on areas with higher growth potential. Management stated that this divestiture goes in tandem with General Mills’ Accelerate strategy and enhances the company’s North America Retail unit’s growth profile. The sale of these businesses will help GIS increase its focus on categories and brands with better opportunities.

The Accelerate Strategy Looks Promising

General Mills is focused on its Accelerate strategy (unveiled in February 2021), which helps the company decide how to win and where to play to boost profitability and enhance shareholders’ returns in the long run. Under how to win, General Mills focuses on four pillars designed to provide a competitive advantage. These include brand building, undertaking innovations, unleashing scale and maintaining business strength. The where to play principle is outlined to enhance the company’s capabilities to generate profitability through geographic and product prioritization and portfolio restructuring. This includes prioritizing investments, investing in five Global Platforms, driving growth in Local Gem brands and reshaping the portfolio.

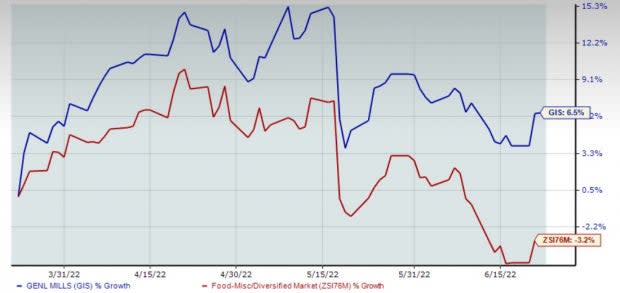

Image Source: Zacks Investment Research

What’s More?

On its third-quarter fiscal 2022 earnings call, management raised the full-year guidance due to the year-to-date performance and the projections of solid top and bottom-line growth in the fiscal fourth quarter. Management expects at-home food demand to stay above pre-pandemic levels as people spend more time working from home. For fiscal 2022, organic net sales are now anticipated to grow roughly 5%, suggesting a projection of a sequential improvement in the organic net price realization and mix. The company earlier expected the metric to grow 4%-5%. The adjusted operating profit at constant currency (cc) is now anticipated between a 2% of decline and flat year over year, indicating a raised organic net sales view. The metric was earlier expected to decline 4%-1%. Adjusted earnings per share (EPS) growth at cc is envisioned to be flat to rise 2%, suggesting an improvement from the earlier guidance of down 2% to up 1%. The revised bottom-line view reflects an increased adjusted operating profit outlook.

Shares of this Zacks Rank #3 (Hold) company have rallied 6.5% in the past three months against the industry’s decline of 3.2%.

3 Solid Staple Stocks

Some better-ranked stocks are Pilgrim’s Pride PPC, Sysco Corporation SYY and Campbell Soup CPB.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen and value-added chicken and pork products, sports a Zacks Rank #1 (Strong Buy). Pilgrim’s Pride has a trailing four-quarter earnings surprise of 31.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for PPC’s current financial-year EPS suggests growth of almost 43% from the year-ago reported number.

Sysco, which engages in marketing and distributing various food and related products, sports a Zacks Rank #1. Sysco has a trailing four-quarter earnings surprise of 9.1%, on average.

The Zacks Consensus Estimate for SYY’s current financial-year sales and EPS suggests growth of 32.6% and 124.3%, respectively, from the year-ago reported number.

Campbell Soup, which manufactures and markets food and beverage products, currently carries a Zacks Rank #2 (Buy). Campbell Soup has a trailing four-quarter earnings surprise of 10.8%, on average.

The Zacks Consensus Estimate for CPB’s current financial-year sales suggests growth of 0.5% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance