GDP and consumers — What you need to know in markets Tuesday

The busy week of economic data picks up steam on Tuesday.

A third quarter GDP revisions and much-anticipated consumer confidence reading will headline the morning.

On Monday, US stocks ended a four-day winning streak. This came after markets finished last week’s holiday-shortened action at a record high.

Data Picks Up

At 8:30 a.m. ET, the second estimate of third quarter GDP is set for release and Wall Street economists expect the measure to show the US economy grew at a rate of 3.1% during the quarter.

This would be a revision from the initial 2.9% reported last month. That initial reading — and the expected revision — marks the strongest quarter for US economic growth since 2014.

“We forecast Q3 GDP growth to be revised modestly to 3.0% q/q saar, from 2.9% in the preliminary estimate,” economists at Barclays wrote.

“In Q3, growth returned to a healthier rate, after soft readings during H1 16, as consumer spending remained in solid footing and the drag from inventories came to an end. We expect the economy to continue expanding at a healthy rate for the rest of this year and next, although uncertainty around our forecasts has increased, given that we only have limited information about the likely fiscal path under the new administration.”

Consumption data inside this report will also be closely watched. The initial print showed a rise of 2.1% in spending during the quarter. Consumer spending accounts for roughly 70% of GDP.

The Conference Board’s consumer confidence survey for November is also set for release Tuesday morning, and should register a reading of 100, up from 98.6 in October.

This reading is among those some economists should be watched more closely in coming months as these are more forward looking than hard-data reports like the jobs report.

Business and consumer surveys, the thinking goes, will give us an idea of where the economy could be headed in the early days of the Trump administration.

On Monday, we got a look at how businesses in Texas are viewing the news. In a word: welcoming.

Elsewhere in economic news on Tuesday, we’ll get a reading on home prices from the S&P/Case-Shiller report and we’ll hear from New York Fed president Bill Dudley and Federal Reserve governor Jerome Powell.

Markets = Fed

The markets and the Federal Reserve… agree on the future of interest rates!

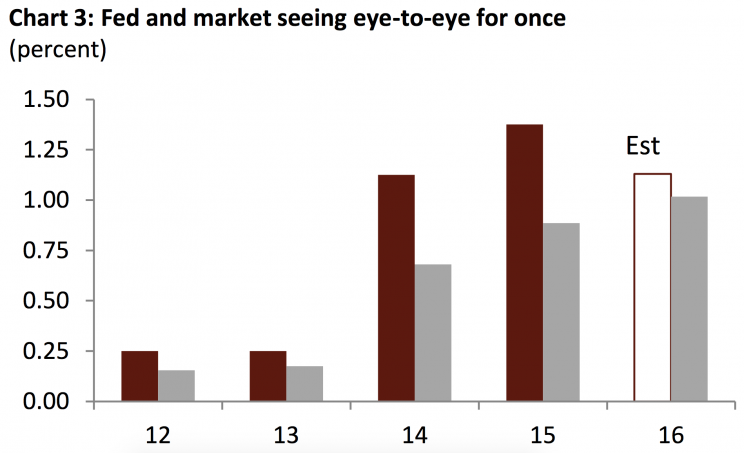

“The market and FOMC head into 2017 with similar views on rates for the first time in years,” writes Neil Dutta, an economist at Renaissance Macro.

“As Chart 3 shows, since QE ended, the market has consistently questioned the Fed’s forecast. For example, last December, the median dot penciled in four hikes this year while the market expected just over two.”

The risk under this scenario, however, is what Dutta calls a “plot twist”: the market might get more aggressive than the Fed.

Consider that over the last several years, some of the most popular charts in markets have been those showing the Fed’s view on future interest rate increases far outpacing those priced in by futures markets. Given that the Fed has raised rates just once since the financial crisis, markets have been right.

But the commentary from Fed Chair Janet Yellen less than two weeks ago — “But because monetary policy is only moderately accommodative, the risk of falling behind the curve in the near future appears limited, and gradual increases in the federal funds rate will likely be sufficient to get to a neutral policy stance over the next few years.” — it seems accelerating inflation and a rapidly-tightening job market could still see the Fed reluctant to raise rates quickly.

“With accelerating wage and price inflation, there is a growing risk that the market sees the Fed as behind the curve, pushing longer-term rates higher,” Dutta writes.

“The Fed tends to move much more slowly than the market. Indeed, some of the recent repricing is the result of policies that have yet to be announced or enacted. It is premature for the Fed to adjust the forecast now. We suspect the Fed leans against the market at first before eventually chasing the steeper curve higher.”

The “Trump Trade” has sent Treasuries higher on expectations of more growth, more inflation, and more supply from a massive infrastructure package. And that is all fine and well. But the Fed, as Dutta outlines, is unlikely to make a material change to its view of how the US economic situation is evolving in just a quarter or two.

The Fed Funds rate, in other words, seems likely to remain lower for longer.

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here; follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance