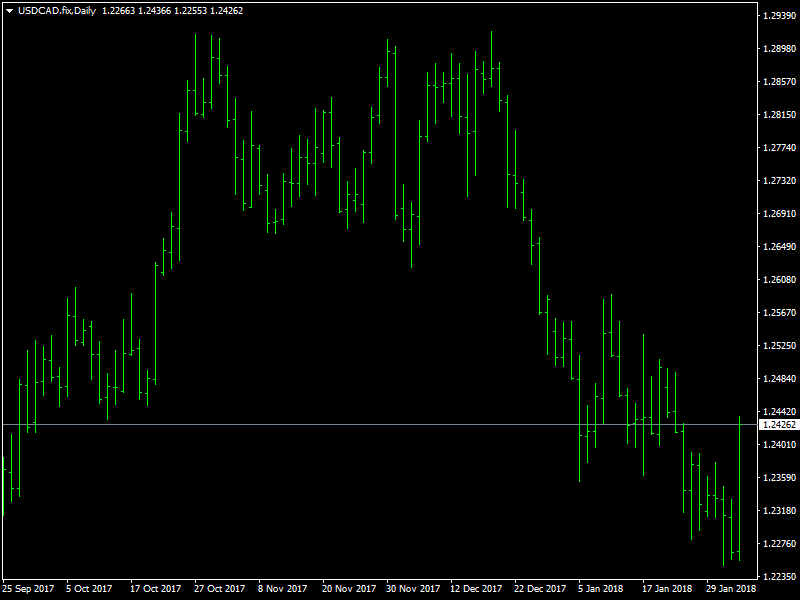

USD/CAD Fundamental Analysis – week of February 5, 2018

After a brief period of weakness earlier in the week, the USDCAD pair gained towards the end of the week, showing the true strength of the dollar which has gained during the course of the week on the back of some strong data. This has happened also due to the fact that the oil prices have also dropped during last week.

USDCAD Moves Forward

The dollar began the week on the backfoot but as the week progressed, the dollar began to gain in strength as the incoming data from the US showed some progress. We saw that the ADP employment report came in much stronger than what was expected. The FOMC meeting minutes were released and this came out slightly more hawkish than what the market was expecting. Though it did not add much new to what the market did not already know, it kept the door open for more than 3 rate hikes from the Fed which would be positive for the dollar if and when that happens. At this time, much of the market expects only 3 hikes from the Fed for this year.

The NFP employment data also came in stronger than expect and though it did not have much of an impact throughout the markets, due to global concerns over rising yields, it was enough to push the pair through the 1.24 region to end the week. In this, the falling oil prices also contributed as it seemed to be impacted by the strong dollar and this negatively impacted the strength of the CAD.

Looking ahead to the coming week, we do not have any major economic data from the US but we have the employment report from Canada, the trade balance and the PMI data as well. All these are likely to have an impact on the CAD as the market looks forward to the next rate hike from the US as well as Canada. They seem to be in a race to hike rates and they seem to be alternating with each other as far as rate hikes are concerned. We believe that the dollar is set for a rebound in the coming week and this should help to test the 1.25 region in the USDCAD pair.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance