GBP/USD Daily Forecast – Sterling Probes Trend Channel Resistance

The pound to dollar exchange rate is attempting to post a third consecutive day of gains and is probing a notable resistance area. GBP/USD turned higher on Monday and extended gains yesterday after an upbeat UK jobs report.

Sterling has been particularly sensitive to incoming data as the Bank of England recently made clear that a rate cut is under consideration. Last week, the three most important economic releases – GDP, consumer price index, and retail sales – all fell short of expectations.

Tuesday’s jobs report has certainly shifted sentiment, however, investors will want to see the outcome of data later in the week. Friday’s release of purchasing managers’ views towards the manufacturing and services industries will be widely watched as it is the last release ahead of next week’s bank meeting. In the last two reports, both the manufacturing and services PMI’s have fallen short of expectations. However, analysts are expecting both have rebound in December.

Technical Analysis

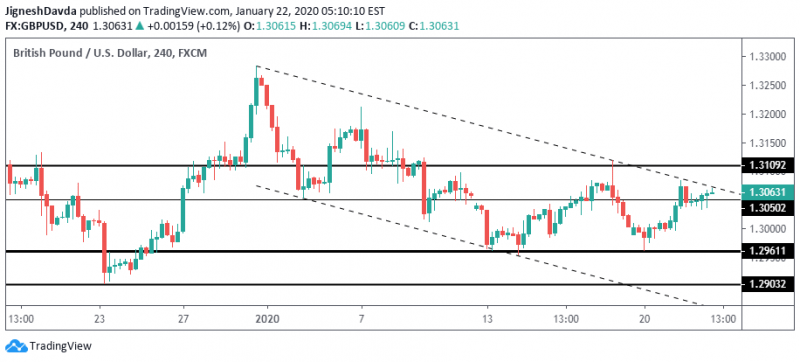

The rally in GBP/USD has met the upper bound of a declining trend channel that has encompassed price action in the year thus far. The same trend channel resistance held the pair lower ahead of last week’s UK retail sales report. The exchange rate fell a few pips short of testing it after yesterday’s jobs report.

This is an important junction for the exchange rate. A bullish break of the channel would signal that the pair might have made a near-term bottom after testing a major resistance level at 1.2961.

The 1.2961 price point derives from a daily chart and was previously considered resistance between October and early December on several attempts.

The price action in the early day, however, does not seem to have a lot of momentum behind it which suggests an upward break might not materialize. Further, in the event one does, it is important to consider that Friday’s data will likely accompany a notable reaction in the exchange rate. While the reaction from trend channel resistance will be important, Friday’s economic release will ultimately set the near-term tone ahead of the BoE meeting.

Bottom Line

GBP/USD is attempting a bullish break from a technical pattern that has been in play for three weeks.

Friday’s UK PMI data is likely to accompany a volatile reaction as it is the last release ahead of the BoE meeting next week.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance