GBP/USD Daily Forecast – Sterling Extends Losses After Failure at 1.3000

Politics and a Stronger Dollar

With GBP/USD turning lower over the past day or so, the question is what is driving the currency pair? Is it UK politics or just a stronger dollar?

In a debate between PM Boris Johnson and opposition Labour’s Corbyn yesterday, polls continued to favor Johnson, although by a small margin. Johnson’s stance is to deliver on the Brexit deal that was negotiated in October. Corbyn vows to let the public decide what the UK will do from here.

Either scenario involves further delays. Holding a referendum to let the public decide on the fate of Brexit could potentially take up to a year. On the other hand, Corbyn argued yesterday that even if a Brexit deal is made in January, trade negotiations are also likely to be a lengthy process.

It seems a bit unclear how much UK politics have impacted GBP/USD as the pair has carried a fairly strong inverse correlation with the US Dollar index (DXY) as of late. DXY bottomed out to start the week and has been gaining upward momentum since. Similarly, GBP/USD hit a fresh four-week high this week and has since pared gains.

Technical Analysis

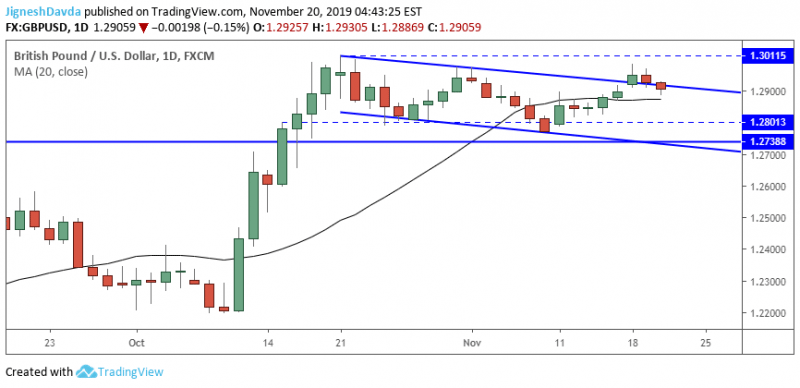

In making those highs, GBP/USD broke upward from a declining trendline that originates from a peak posted in late October.

In yesterday’s forecast, I outlined a few different scenarios that could play out. One of them was a sell off that would see the pair printing a bearish engulfing candle on a daily chart. This is where we are now.

The price action over the past 24-hours shows a lack of buying from the mentioned declining trendline. This is not encouraging for those taking the bullish side. At the same time, the trendline has not been breached to a point where I would consider the early-week breakout invalidated.

This levels us somewhere in the middle, without a clear signal. But I do think price action will clarify the outlook later today as the minutes from the last Fed meeting are scheduled for release. This stands to introduce a bit of volatility which could clarify the near-term bias for the pair.

For now, the pair trades at fairly important support. this comes from the 1.2900 handle as well as the lower bound of a trend channel that has encompassed price action since the start of the week.

Bottom Line

GBP/USD has given back a bulk of its weekly gain as the dollar is recovering.

An early week bullish breakout is on the verge of being invalidated. In this context, the reaction following the meeting minutes is important.

A push back above 1.2940 would tend to encourage bulls once again.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance