GBP/USD Daily Forecast – Sterling Eases From 2-Week high

Brexit Talks Remain at an Impasse

The markets had a glimpse of optimism yesterday when Germany’s Merkel said that a resolution might be reached regarding the Irish backstop. However, she expressed that the withdrawal agreement did not need to be amended and that discussions should take place after the formal EU exit.

UK PM Boris Johnson has been insisting on reopening the withdrawal agreement. He sent a letter urging to the European Union President Donald Tusk earlier this week to that effect. He has held a hard stance on the matter and continues to remind EU officials that if the deal is not amended, the UK will leave without a deal.

Johnson is meeting Merkel in Germany and French President Macron in France this week, in his first foreign trip since being elected.

The main issue in the divorce continues to be the Irish backstop. EU officials are hard set on keeping it in place and Johnson has made his stance clear. In this context, I don’t think Johnson’s trip abroad will yield any results, or rather any progress in moving along Brexit talks. There is, of course, some headline risk, and so far the headlines have moved Sterling higher.

Technical Analysis

Yesterday’s comments from Merkel saw GBP/USD jump higher a bit, above a key resistance area. Considering the price action, I think a lot of the negativity associated with Brexit is priced in at this stage.

That’s not to say that a no-deal Brexit is priced in. Rather that the pair stands to gain even on a hint that a deal can be made. For that reason, I continue to look for more upside in GBP/USD.

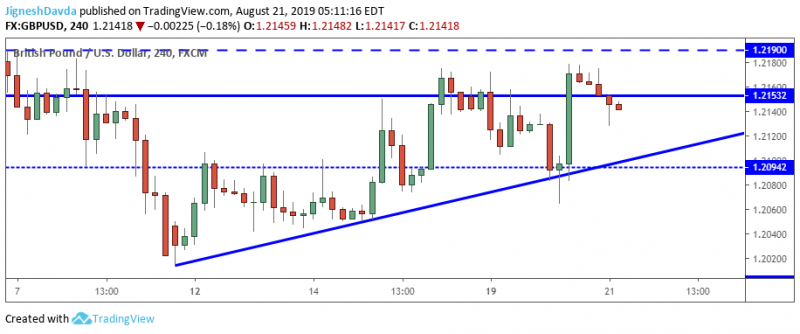

A key metric that was mentioned in yesterday’s daily forecast is a rising trendline that originates from last week’s low. Yesterday I talked about a potential overshoot of the trendline but that the 61.8% Fibonacci level of the last leg up should hold.

So far, the trendline is holding and the pair posted a bullish candlestick pattern after briefly dipping below it yesterday. There is a bit of a decline today in early trading although it is lacking momentum.

I expect that dips toward the trendline will continue to be bought. I see support at 1.2094 as a strong area for buyers and would expect the pair stays above it to maintain it’s upward momentum.

Bottom LIne

GBP/USD continues to grind higher. A rising trendline has guided the move up.

There is some hope of a smooth Brexit on Merkel’s comments, but realistically, talks are not moving forward.

I think the pair needs to remain above 1.2094 to stick with a bullish near-term view.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance