GBP/USD Daily Forecast – Sterling Holds Below Key Resistance

Overhead Resistance Continues to Block Rallies

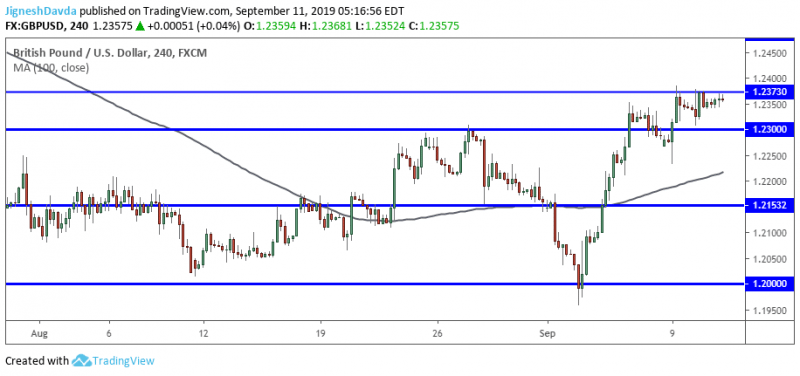

GBP/USD made another attempt at 1.2373 resistance yesterday but sellers dominated to hold the pair below it. Volatility has slowed since late last week as market participants await the next move in progressing a UK exit from the European Union.

Last week was a volatile one as lawmakers effectively blocked UK Prime Minister Boris Johnson from leaving the EU without a deal in place. The PM called for a snap election twice but failed on both attempts.

The intent for calling an election was so that Johnson could bypass the law that prevents an exit without a deal. Although there is some benefit of an election to the opposition, they saw through the PM’s plan and swiftly opposed it.

Johnson will be faced with the task of negotiating terms with EU officials without threatening an exit without a deal. German Chancellor Angela Merkel seemed optimistic as she commented that there is still a chance of an orderly Brexit. However, not every EU official shares her optimism.

Economic data out of the UK has been stronger than expected this week. Both GDP and unemployment figures came in ahead of expected which have helped maintain Sterling’s recent strength in the early week.

Technical Analysis

Not much has changed in the technical outlook for GBP/USD in the past few sessions. Overhead resistance at 1.2373 has continued to provide a significant hurdle.

The dollar is catching a firm bid in the early day once again. This might translate into some downside pressure for the currency pair.

The US dollar index (DXY) has rallied to briefly pierce to a one-week high today before parring some of the gains. If the index makes a sustained breakout, I expect GBP/USD will follow and head lower. Especially so since the above-mentioned resistance level has been well respected in the past few sessions.

In such a scenario, the first level of downside support is seen at 1.2300.

Bottom Line

GBP/USD has lost upside momentum and major resistance is in play at 1.2373.

The dollar is trying to break higher in the early day. A sustained breakout from a one-week range in the dollar index stands to put pressure on GBP/USD.

This article was originally posted on FX Empire

More From FXEMPIRE:

USD/JPY Fundamental Daily Forecast – Supported by Fading Concerns Over Global Economic Slowdown

Trump Blasts Fed, Market Expects Deep Rate Cuts, Inflation Data Hotter Than Expected

EUR/USD Daily Forecast – Euro Under Pressure, Threatens Range Break

Natural Gas Price Fundamental Daily Forecast – Weak Spot Prices Could Trigger Steep Plunge

Yahoo Finance

Yahoo Finance