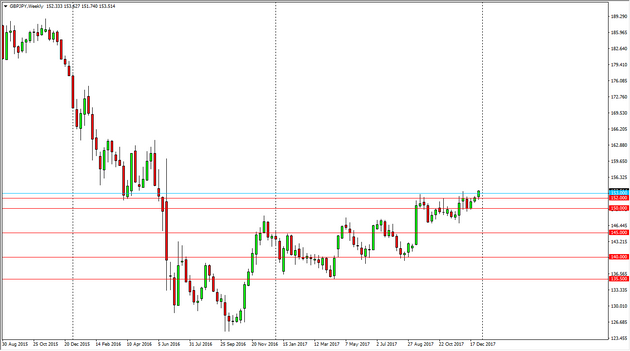

GBP/JPY Price forecast for the week of January 8, 2018, Technical Analysis

The British pound initially gapped higher at the open of the week, but then fell to fill the gap and find buyers. Because of this and the fact that we have moved above the 153 handle, the market looks likely to go much higher. I believe that the next target will be the 153 handle, followed very quickly by the 160 handle, and then eventually the 163 level. The pair is very sensitive to risk appetite, so if we continue to see strength in the stock markets and/or the commodity markets, that should give us enough “risk on” attitude to send this market higher.

I believe there’s a hard “floor” in the market near the 150 handle, so it’s not until we break down below there that I would consider selling this pair. There might be headlines occasionally that have people running for safety, and that of course will put a negative slant into this pair, but you can see that we have spent most of the year rallying very slowly as investors and so-called “smart money” continues to pick up the British pound after it was so massively sold off the last couple of years. In general, I believe that this market should continue to go to the upside, and therefore have no interest in shorting, least not until we break down below the previously mentioned 150 handle. Longer-term, I think that a lot of investors are getting involved, and plan to hold this pair for a very long time. We could go as high as 190 by the time the entire selloff has been retraced.

GBP/JPY Video 08.01.18

This article was originally posted on FX Empire

More From FXEMPIRE:

ETH/USD Price forecast for the week of January 8, 2018, Technical Analysis

S&P 500 Price forecast for the week of January 8, 2018, Technical Analysis

USD/JPY Price forecast for the week of January 8, 2018, Technical Analysis

Bitcoin Gold DASH and Monero Price forecast for the week of January 8, 2018, Technical Analysis

Gold Price forecast for the week of January 8, 2018, Technical Analysis

FTSE 100 Price forecast for the week of January 8, 2018, Technical Analysis

Yahoo Finance

Yahoo Finance