GATX Stock Surges 35% Year to Date: What's Behind the Rally?

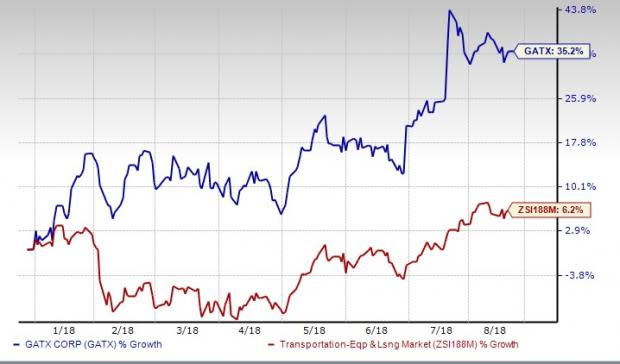

Shares of GATX Corporation GATX have rallied 35.2% so far this year, handily outperforming its industry’s 6.2% growth.

YTD Price Performance

Reasons Behind the Rally

GATX performed impressively in the second quarter of 2018, reporting better-than-expected earnings per share and revenues. Moreover, the top line increased on a year-over-year basis. Apart from the outperformance, the company raised its outlook for 2018 earnings per share owing to improved market conditions.

For 2018, the company expects earnings per share between $4.90 and $5.10 (earlier guidance: $4.55-$4.75). The Zacks Consensus Estimate for current-year earnings is pegged at $5.08 per share, at the high end of the guided range. GATX’s initiatives to modernize its fleet are encouraging as well.

Additionally, the company’s efforts to reward its shareholders through share buybacks and dividend payments look promising. We note that GATX has been paying regular dividends continuously since 1919. In January, the company raised its quarterly dividend by 5% to 44 cents per share.

GATX's trailing 12-month return on equity (ROE) too supports its growth potential. Notably, the company’s ROE of 11.3% compares favorably with ROE of 9.1% for its industry. The favorable reading portrays management’s efficiency in rewarding shareholders with attractive risk-adjusted returns.

Apart from this Zacks Rank #2 (Buy) company, other transportation operators like Union Pacific Corporation UNP, Norfolk Southern Corporation NSC and Southwest Airlines Co. LUV have raised their respective dividend payouts this year. Huge savings owing to the Tax Cuts and Jobs Act led to the dividend hike.

With a low effective tax rate, companies are now left with huge savings to augment their free cash flow. This surge in free cash flow is enabling them to engage in such shareholder-friendly activities.

Earnings Estimates on an Upswing

Upward estimate revisions reflect optimism in a stock’s prospect. GATX scores impressively on this front too. The Zacks Consensus Estimate for current-quarter and year earnings moved north 2.9% and 8.1%, respectively, over the last 60 days.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwest Airlines Co. (LUV) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance