Fresenius Medical (FMS) Misses Q2 Earnings & Sales Estimates

Fresenius Medical Care AG & Co. KGaA (FMS) posted adjusted earnings of 54 cents per share, which missed the Zacks Consensus Estimate by 10%. Earnings improved 6% year over year at constant currency (cc).

In the quarter under review, revenues climbed 2% at cc to $5.03 billion, which lagged the Zacks Consensus Estimate of $5.33 billion. Per management, the company’s revenues were partially impacted by foreign currency. Furthermore, management stated that revenues saw stable growth in the first half of 2018.

The stock carries a Zacks Rank #3 (Hold). Fresenius Medical has outperformed its industry in the past year. The company’s shares have returned 5.5% against the industry's decline of 8.2%.

Segmental Details

In the second quarter, Fresenius Medical reported through two segments — Health Care Services and Health Care Products.

Health Care Services revenues improved 1% at cc on a year-over-year basis and 3% organically. Growth in the segment was driven by rise in same-market treatments and synergies from acquisitions.

Health Care Products revenues increased 6% at cc and organically. Per management, the rise was driven by higher sales of hemodialysis products and renal pharmaceuticals. Dialysis treatments increased 3%.

Geographical Growth

North America

Per management, this region accounted for 71% of revenues in the reported quarter. Revenues in the region rose 4% at cc and 3% organically. The growth was mainly driven by an increase in organic revenue per treatment, same market treatment growth and contributions from acquisitions.

It is encouraging to note that Health Care Products revenues registered a strong increase of 10% at cc in the United States. The upside can be attributed to higher sales of renal pharmaceuticals, machines and hemodialysis concentrates. However, a decline in external sales of peritoneal dialysis products marred the overall positive development.

EMEA

Revenues in this zone improved 5% at cc in the quarter. Per management, the upside was driven by improvement in Health Care Services revenue and Health Care Products revenues, which increased 5% and 4%, respectively at cc. Moreover, dialysis Products revenues grew 5% at cc on higher sales of dialyzers, machines, bloodlines, products for acute care treatments and renal pharmaceuticals.

In the first half of 2018, EMEA revenues climbed 5% at cc.

Asia-Pacific

Revenues grew 7% at cc in the quarter. The region saw a revenue improvement in Health Care Services of 7% at cc and strong Care Coordination activities. Care Coordination growth was mainly backed by acquisitions. Health Care Products also put up solid performance, growing 6% at cc. Per management, this growth was mainly driven by higher sales of hemodialysis products. However, this was partially affected by lower sales of products for acute care treatment. The company also saw solid growth in China.

Latin America

Revenues in this region saw an improvement of 11% at cc on the back of strong growth in Health Care Services. Health Care Products revenues in the region increased 2% at cc buoyed by higher sales of machines and peritoneal dialysis products. However, the growth was partially offset by lower dialyzer sales.

Margin

Gross profit declined 12.8% in the quarter and 6.8% at cc.

As a percentage of revenues, gross margin was 30.9%, down 250 basis points (bps) in the second quarter.

Guidance

For 2018, Fresenius Medical expects revenue growth in the range of 5-7% at cc. Notably, the Zacks Consensus Estimate for revenues is pegged at $21.32 billion.

Adjusted net income is expected to grow 7-9% at cc.

In Conclusion

Fresenius Medical saw a tepid second quarter, with both earnings and revenues missing estimates. Solid performance by the core Health Care Services and Health Care Product units buoy optimism. Higher sales of the company’s dialysis and hemodialysis products are a positive. Care Coordination margin improved significantly on synergies from the Cura acquisition. In fact, management is optimistic about the recent buyouts of Sound Physicians and NxStage Medical. Furthermore, strong sales in the North America, EMEA, Asia-Pacific and Latin America regions paint a bright picture.

On the flip side, peritoneal dialysis product sales declined in the quarter. A significant contraction in gross margin is another negative. Another matter of concern for Fresenius Medical is the stringent regulations it faces in almost every country in which it operates.

Q2 Earnings of MedTech Majors at a Glance

A few better-ranked stocks in the broader medical space, which reported solid earnings this season, are Stryker Corporation (SYK), Intuitive Surgical, Inc (ISRG) and Illumina, Inc (ILMN).

While Intuitive Surgical and Illumina sport Zacks Rank #1 (Strong Buy), Stryker carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical reported adjusted earnings of $2.76 per share in the second quarter of 2018, which beat the Zacks Consensus Estimate of $2.48. Adjusted earnings improved 38% year over year.

Stryker reported second-quarter 2018 adjusted earnings per share of $1.76, beating the Zacks Consensus Estimate by 1.7%. Earnings improved 15% year over year and also exceeded the high end of the company’s guidance.

Illumina reported adjusted earnings of $1.43 per share, beating the Zacks Consensus Estimate of $1.11.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Fresenius Medical Care AG & Co. KGaA FMS posted adjusted earnings of 54 cents per share, which missed the Zacks Consensus Estimate by 10%. Earnings improved 6% year over year at constant currency (cc).

In the quarter under review, revenues climbed 2% at cc to $5.03 billion, which lagged the Zacks Consensus Estimate of $5.33 billion. Per management, the company’s revenues were partially impacted by foreign currency. Furthermore, management stated that revenues saw stable growth in the first half of 2018.

The stock carries a Zacks Rank #3 (Hold). Fresenius Medical has outperformed its industry in the past year. The company’s shares have returned 5.5% against the industry's decline of 8.2%.

Segmental Details

In the second quarter, Fresenius Medical reported through two segments — Health Care Services and Health Care Products.

Health Care Services revenues improved 1% at cc on a year-over-year basis and 3% organically. Growth in the segment was driven by rise in same-market treatments and synergies from acquisitions.

Health Care Products revenues increased 6% at cc and organically. Per management, the rise was driven by higher sales of hemodialysis products and renal pharmaceuticals. Dialysis treatments increased 3%.

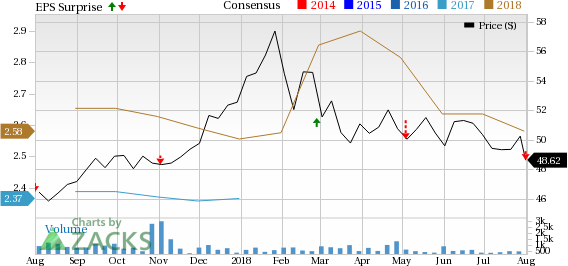

Fresenius Medical Care Price, Consensus and EPS Surprise

Fresenius Medical Care Price, Consensus and EPS Surprise | Fresenius Medical Care Quote

Geographical Growth

North America

Per management, this region accounted for 71% of revenues in the reported quarter. Revenues in the region rose 4% at cc and 3% organically. The growth was mainly driven by an increase in organic revenue per treatment, same market treatment growth and contributions from acquisitions.

It is encouraging to note that Health Care Products revenues registered a strong increase of 10% at cc in the United States. The upside can be attributed to higher sales of renal pharmaceuticals, machines and hemodialysis concentrates. However, a decline in external sales of peritoneal dialysis products marred the overall positive development.

EMEA

Revenues in this zone improved 5% at cc in the quarter. Per management, the upside was driven by improvement in Health Care Services revenue and Health Care Products revenues, which increased 5% and 4%, respectively at cc. Moreover, dialysis Products revenues grew 5% at cc on higher sales of dialyzers, machines, bloodlines, products for acute care treatments and renal pharmaceuticals.

In the first half of 2018, EMEA revenues climbed 5% at cc.

Asia-Pacific

Revenues grew 7% at cc in the quarter. The region saw a revenue improvement in Health Care Services of 7% at cc and strong Care Coordination activities. Care Coordination growth was mainly backed by acquisitions. Health Care Products also put up solid performance, growing 6% at cc. Per management, this growth was mainly driven by higher sales of hemodialysis products. However, this was partially affected by lower sales of products for acute care treatment. The company also saw solid growth in China.

Latin America

Revenues in this region saw an improvement of 11% at cc on the back of strong growth in Health Care Services. Health Care Products revenues in the region increased 2% at cc buoyed by higher sales of machines and peritoneal dialysis products. However, the growth was partially offset by lower dialyzer sales.

Margin

Gross profit declined 12.8% in the quarter and 6.8% at cc.

As a percentage of revenues, gross margin was 30.9%, down 250 basis points (bps) in the second quarter.

Guidance

For 2018, Fresenius Medical expects revenue growth in the range of 5-7% at cc. Notably, the Zacks Consensus Estimate for revenues is pegged at $21.32 billion.

Adjusted net income is expected to grow 7-9% at cc.

In Conclusion

Fresenius Medical saw a tepid second quarter, with both earnings and revenues missing estimates. Solid performance by the core Health Care Services and Health Care Product units buoy optimism. Higher sales of the company’s dialysis and hemodialysis products are a positive. Care Coordination margin improved significantly on synergies from the Cura acquisition. In fact, management is optimistic about the recent buyouts of Sound Physicians and NxStage Medical. Furthermore, strong sales in the North America, EMEA, Asia-Pacific and Latin America regions paint a bright picture.

On the flip side, peritoneal dialysis product sales declined in the quarter. A significant contraction in gross margin is another negative. Another matter of concern for Fresenius Medical is the stringent regulations it faces in almost every country in which it operates.

Q2 Earnings of MedTech Majors at a Glance

A few better-ranked stocks in the broader medical space, which reported solid earnings this season, are Stryker Corporation SYK, Intuitive Surgical, Inc ISRG and Illumina, Inc ILMN.

While Intuitive Surgical and Illumina sport Zacks Rank #1 (Strong Buy), Stryker carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical reported adjusted earnings of $2.76 per share in the second quarter of 2018, which beat the Zacks Consensus Estimate of $2.48. Adjusted earnings improved 38% year over year.

Stryker reported second-quarter 2018 adjusted earnings per share of $1.76, beating the Zacks Consensus Estimate by 1.7%. Earnings improved 15% year over year and also exceeded the high end of the company’s guidance.

Illumina reported adjusted earnings of $1.43 per share, beating the Zacks Consensus Estimate of $1.11.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Fresenius Medical Care (FMS) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance