Franco-Nevada Rides on Oil & Gas Prices, Gold Prices a Woe

On May 15, we issued an updated research report on Franco-Nevada Corporation FNV. The company appears to be on a promising long-term trajectory, aided by its healthy portfolio of streaming and royalty agreements. However, lower gold prices remain a concern.

Franco-Nevada delivered adjusted earnings of $65.2 million or 35 cents per share in first-quarter 2019, up from the prior-year quarter’s $63.9 million or 34 cents per share. In addition, the earnings per share figure surpassed the Zacks Consensus Estimate of 28 cents. Net sales in the quarter rose 3.8% year over year to $179.8 million and also beat the Zacks Consensus Estimate of $166 million.

Franco-Nevada’s shares have appreciated 8.5% in the past year, outperforming the industry’s growth of 4.2%.

Momentum in Oil & Gas Portfolio to Drive Growth

Performance of Oil & Gas remains robust, with revenues of $20.8 million recorded in the first quarter of 2019, up from the year-ago quarter’s $19 million. This can be attributed to higher oil prices and increased production from the U.S. assets. During the quarter, energy revenues benefited from the company’s investment in the Royalty Acquisition Venture with Continental. Moreover, Drill activity is higher and drilling productivity is better than expected.

Backed by better-than-anticipated contribution from its previously-acquired U.S. assets and higher oil prices, Franco-Nevada projects revenues between $70 million and $85 million from its energy assets in 2019.

Strategic Relationship With Continental Resources A Key Catalyst

Last October, Franco-Nevada contributed $214.8 million to close its transaction with Continental Resources, Inc., in order to acquire the Oil & Gas mineral rights in the SCOOP and STACK plays of Oklahoma — two of the most economic and attractive plays in North America. The company has also committed, subject to satisfaction of agreed upon development thresholds, to spend up to $300 million over the next three years to acquire additional mineral rights through a newly-formed entity.

This represents a new business-development opportunity for Franco-Nevada. It gets an acquisition vehicle, which provides the ability to acquire assets at the grassroots level or directly from individual owners. This is a segment of the market previously inaccessible to the company due to lack of staff or resources for carrying out such smaller-scale acquisitions. More importantly, Franco-Nevada benefits from the operators’ drill plans, along with their knowledge of local land title and geology.

Cobre Panama Project & Candelaria Mine Bode Well

Franco-Nevada has completed its $1-billion commitment for the Cobre Panama project. In first-quarter 2019, Cobre Panama began its initial production and expects to produce 140,000-175,000 tons of copper in the current year. The company forecasts milling operation at an annualized rate of 72 million tons per year, by the end of this year. It also expects this project to reach its mill throughput capacity of 100 million tons per year in 2023. For the ongoing year, the company anticipates to produce 20,000-40,000 ounces gold from Cobre Panama project. The Candelaria mine operation is likely to benefit in the second half of 2019 from more than $1 billion in fleet purchases, stripping and development. The company expects improvement in gold and silver deliveries from Candelaria in the second half of 2019.

Franco-Nevada remains optimistic about attributable royalty and stream production to total 465,000-500,000 Gold Equivalent Ounces (GEOs) from its mining assets for 2019.

Poised Well for the Long Term

Franco-Nevada strives to generate revenues from precious metals over long-term horizon. With precious metals generating around 88.4% of revenues during the March-end quarter, the company has the flexibility to consider diversification opportunities outside of the precious metals’ space and increase exposure to other commodities while maintaining its long-term target.

Further, Franco-Nevada appears to be on a promising long-term trajectory backed by a healthy portfolio of streaming and royalty agreements put in place years ago. With more mines coming online in the next several years, it will benefit from higher levels of precious metal sales and higher prices.

The company had previously guided a solid growth outlook till 2023, forecasting production in the range of 570,000-610,000 GEOs by 2023. With the continued development of its U.S. oil & gas assets, the company expects energy assets to contribute 16-17% of revenues by 2023. Moreover, the company has planned expansion or start-up of a number of smaller mines over 2019, and more than 50% expansion of Stillwater by 2021. Furthermore, Franco-Nevada’s balance sheet remains debt free.

Concern Over Lower Gold Prices

The prices of precious metals, particularly gold, are a determining factor for profitability for Franco-Nevada. Gold prices have been affected by the trade tussle between the United States and China, interest-rate hikes and a stronger dollar in the past year. During first-quarter 2019, average prices of gold and silver were down. Lower prices are likely to weigh on Franco-Nevada’s performance. Moreover, the company’s GEOs may be affected by commodity-price volatility.

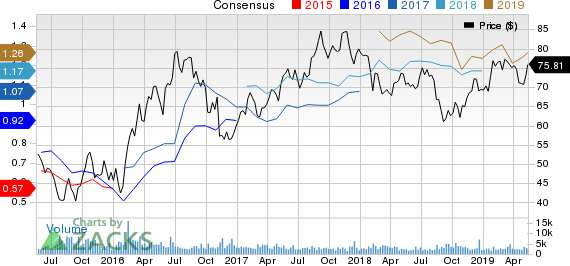

Franco-Nevada Corporation Price and Consensus

Franco-Nevada Corporation price-consensus-chart | Franco-Nevada Corporation Quote

Zacks Rank & Stocks to Consider

Franco-Nevada currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Basic Materials space are Israel Chemicals Ltd. ICL, Arconic Inc. ARNC and Arch Coal Inc. ARCH, each carrying a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Israel Chemicals has an expected earnings growth rate of 13.51% for 2019. The company’s shares have gained 17.3% in the past year.

Arconic has an estimated earnings growth rate of 31.62% for the current year. The stock has appreciated 22.5% in a year’s time.

Arch Coal has a projected earnings growth rate of 16.7% for the ongoing year. Its shares have rallied 17.7% over the past year.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Israel Chemicals Shs (ICL) : Free Stock Analysis Report

Arch Coal Inc. (ARCH) : Free Stock Analysis Report

Franco-Nevada Corporation (FNV) : Free Stock Analysis Report

Arconic Inc. (ARNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance